Artificial intelligence: An X-factor in a new investment regime

Analyzing the potential long-term economic boost from AI

Originally published by our U.S. partners.

Highlights

- After studying the growth of past transformational technologies, we believe artificial intelligence (AI) could be a multiyear investment theme and may lead to higher productivity over time, making labor and capital more efficient, facilitating more innovation, increasing consumer buying power, and supporting corporate profit margins.

- Adoption rates for AI and possible productivity gains related to it are likely to vary by sector—more heavily impacting service segments, for example—and any broad contributions to overall economic productivity could be years away.

- However, AI could also pose significant economic and societal costs that may constrain the spread of this technology.

The link between AI, productivity, and profits

Fidelity’s Asset Allocation Research team (AART) recently found potential catalysts that could re-ignite productivity after an extended

period of weak growth and a decoupling from corporate profits in a paper titled “A Strategic Allocator’s Guide to Productivity and

Profits.” Although our base-case forecasts in that paper do not indicate a productivity boom ahead, we suspect shifting secular trends could potentially boost productivity rates. These include changes in interest rates and labor costs, as well as reshoring, onshoring, and near-shoring initiatives and efforts to address climate

change. We believe that, as a result, public investment and capex could rise from depressed levels and catalyze productivity. Alongside

these forces, breakthroughs in AI could be another source of future productivity gains.

Productivity is typically measured as output per hour worked. This measure reflects labor productivity and is a function of labor

composition (the quality of human capital), capital intensity (how much capital workers use to produce goods and services), and multifactor productivity (the overall efficiency with which labor and capital are used together).

AI holds promise for accelerating overall productivity and multifactor productivity (ultimately the core driver of long-term growth). It may do so directly by making labor and capital more efficient, and indirectly by facilitating further innovation. Framing the opportunity for AI as an investment theme and the potential productivity upside of the technology is what we set out to accomplish in this paper.

Summary of the Research

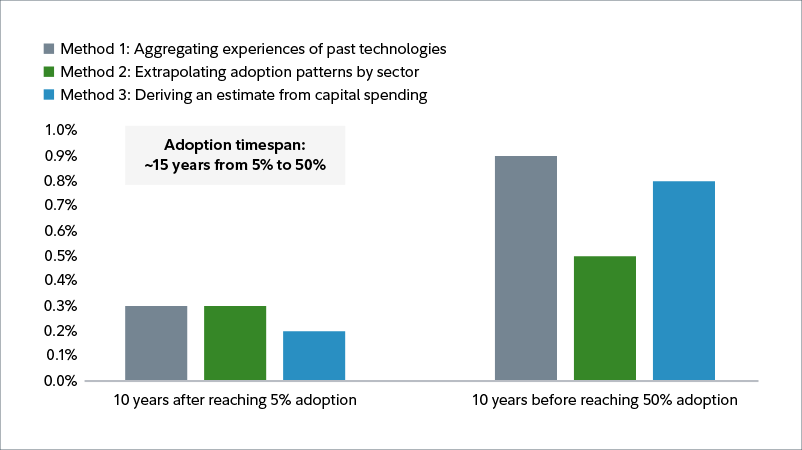

The AART team studied the potential for AI to increase economic productivity using three different methods: by studying the historical productivity increases of past technologies; extrapolating adoption patters by sector, and deriving an estimate from capital spending.

Each method presented slightly different estimates. That said, each similarly concluded that the productivity increase derived from AI would likely be fairly slow in the early going, as the adoption rate improved over a period of roughly 15 years. It would, however, increase as AI technologies became widely adopted. Exhibit 1 shows the summary results of the research.