A pioneer of target date strategies, launching our first solution in 1996.

Our approach is powered by glide path design and a balanced approach to risk.

A pioneer of target date strategies, launching our first solution in 1996.

One of the largest asset managers, with over $895 billion in target date assets in North America1.

A market leader committed to ongoing innovation to improve retirement outcomes for plan members.

1 As at December 31, 2024, in Canadian dollars.

Fidelity ClearPath® Portfolios are designed for Canadian investors. Shaped by key drivers of long-term outcomes, our unique glide path reflects actual behaviours of Canadian plan members.

Glide path design is informed by research in three critical areas:

With many Canadians depending on defined contribution plans as their primary source of retirement income, plan sponsors can design their plans to target specific income replacement goals, helping members maintain their standard of living in retirement.

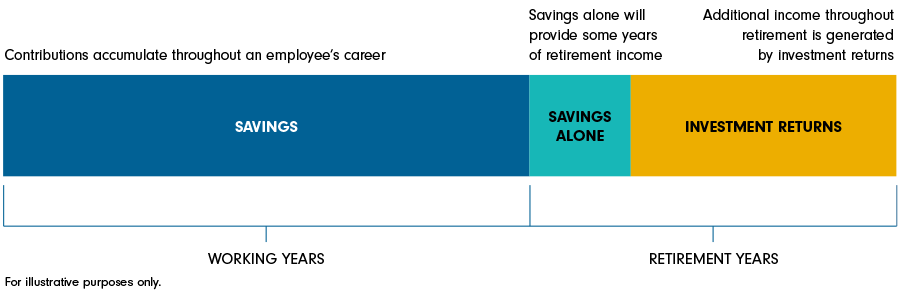

It is important to recognize that savings alone may not provide an adequate level of income replacement throughout a retirement that could last 25–30 years.

We believe the greatest risk for an investor saving for retirement is experiencing a shortfall in retirement income.

Fidelity ClearPath Portfolios are designed to help Canadian investors solve the challenge of investing through retirement. Our glidepath is designed to provide members with active asset allocation, with the goal of delivering additional income to last through retirement.

Get an overview of our suite of target date solutions.

Learn more about the newest addition to our suite of target date solutions.

Learn more about how ClearPath Portfolios can benefit your plan members.

Get insights on our target date strategies.

Learn more about how they work

Discover the basics of target date strategies, potential benefits, and practical tips for choosing the right strategy.

Hear from our portfolio managers as they discuss their investment approach