Purpose-driven investing for DB pension plans

A new investment framework to balance risk and growth.

Highlights

- Interest rate movements present a narrowing window of opportunity.

- What is de-risking, and what traditional approaches are available?

- Choosing the right approach: CDI or LDI?

- Purpose-driven investing: Liability risk management and growth portfolio

- De-risking in practice

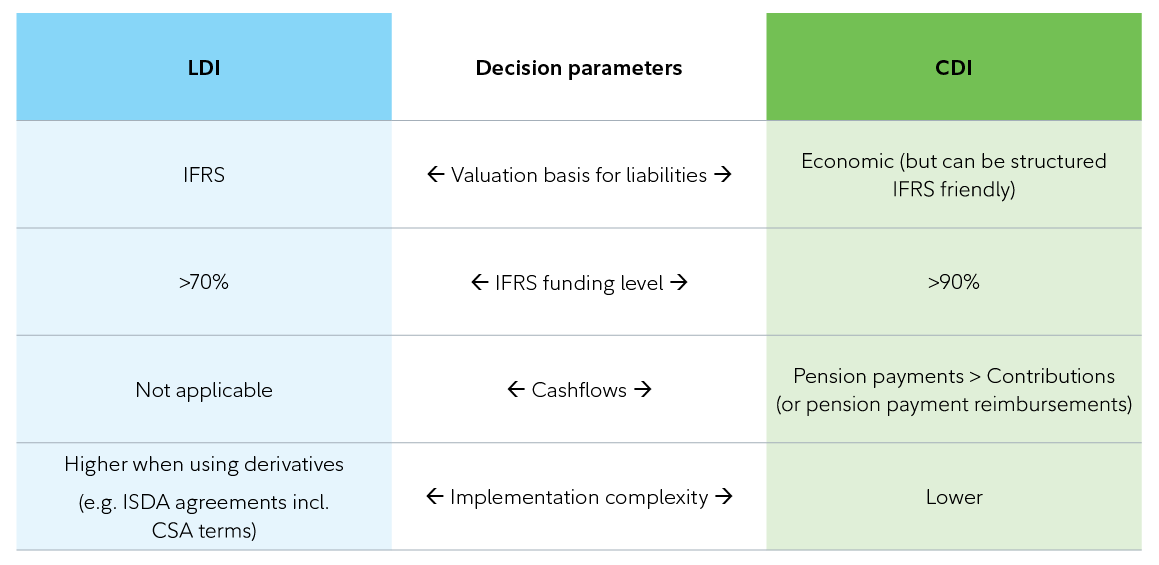

Choosing the right approach

Whether CDI or LDI (or a combination of both) is optimal depends on a number of factors, including the status quo, overarching objectives and restrictions of the pension plan. However, there are a few decision parameters that pension plans can use as a guide.

The below guide is not exhaustive but based on our discussions with pension plans.

Source: Fidelity, 2024. For illustrative purpose only.