Home country bias: How much Canada should Canadian investors own?

Where Canadian investors were once restricted, they’ve been spurred on to draw down their exposure to Canadian assets, in part due to strong U.S. investment performance, a volatile interest rate environment and acute macroeconomic headwinds faced by the Canadian economy.

If the posture of market participants is correct, enhancing and diversifying the drivers of portfolio risk should bolster risk-adjusted returns. However, one’s frame of reference is critical, and our analysis suggests that there are limits to the degree to which Canadian investors should “sell Canada” in their strategic allocations. Multi-asset investors in Canada, especially those managing asset-liability exercises, enjoy differentiated payoffs compared to global peers.

What Canadian equities bring to the portfolio

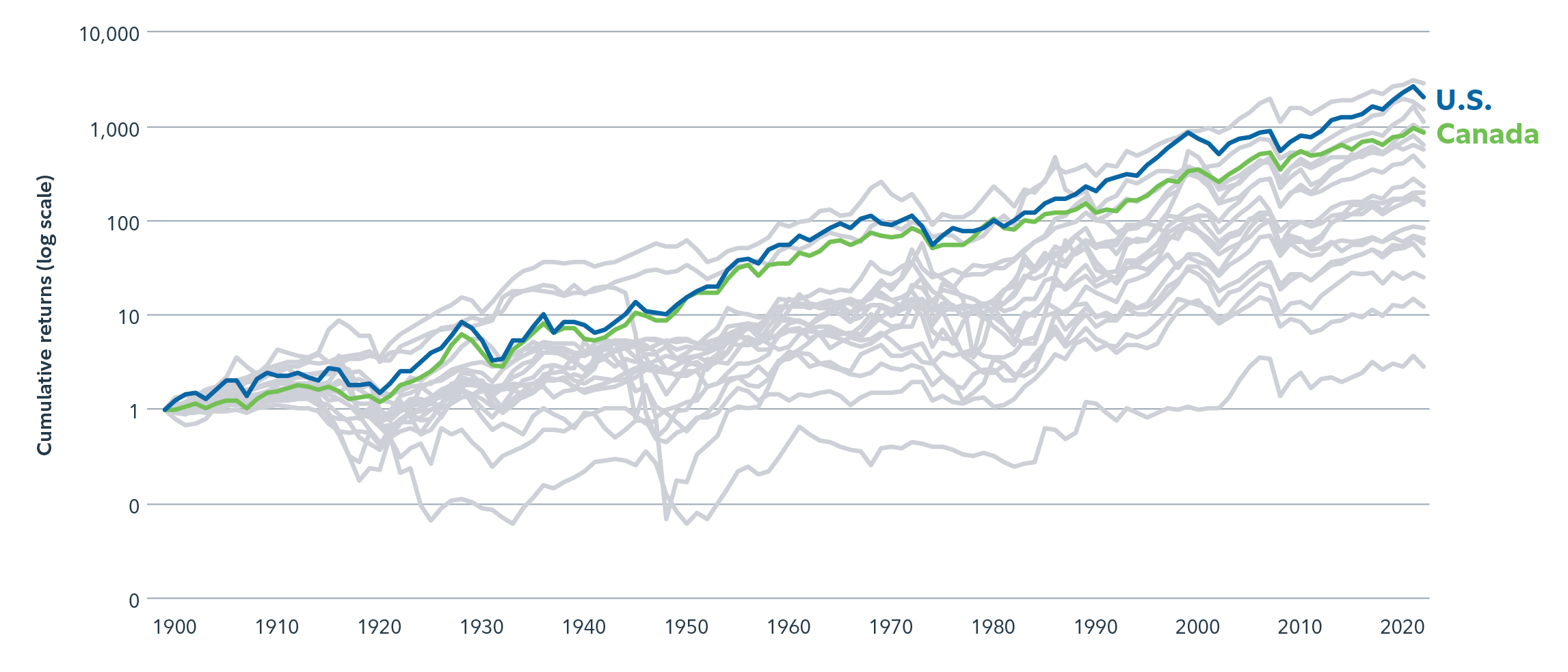

The long-term history of Canadian equities typically surprises investors. While it is not grabbing the same headlines as Japanese equities did during the 60’s, 70’s and 80’s, or equalling the last two decades of dominant outperformance we’ve seen from U.S. equities, Canadian equities have long been a compelling market that has generated strong investment outcomes (Exhibit 1).

Highlights

- The makeup of Canadian equities offers distinct risk-and-return attributes relative to global equity peers, producing favourable diversification in specific market environments.

- Historically, the Canadian dollar (CAD) has exhibited pro-cyclical risk and return properties. This dynamic motivates a differentiated approach to portfolio construction.

- Canadian target-date investors benefit from different levels of Canadian exposure in their portfolios as their lifecycle evolves.

- Canadian investors with CAD denominated retirement savings goals should consider allocating a larger portion of their portfolio to Canadian investments.