Fulcrum Issues: Are we there yet?

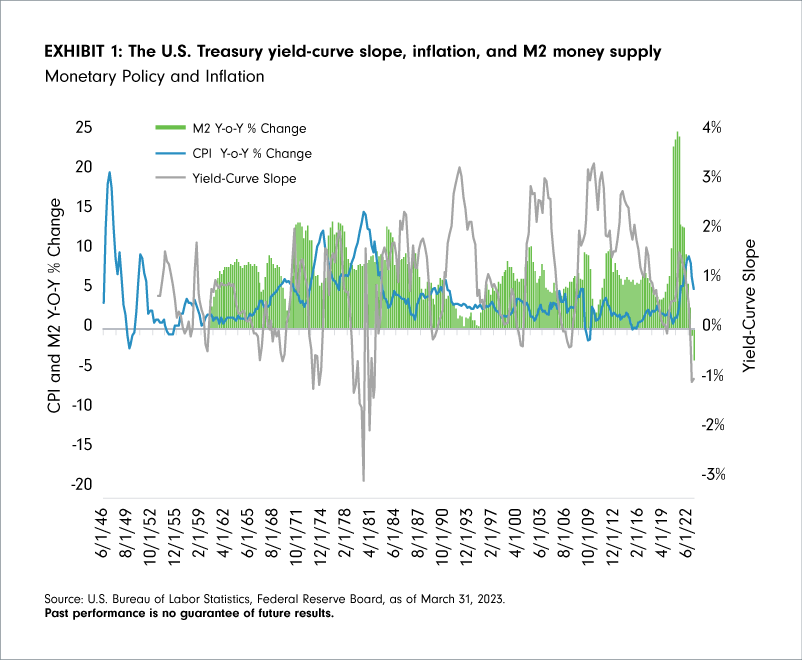

Shifting expectations on the direction of the Fed’s monetary policy amid rising concerns about growth and inflation.

A feature article from our U.S. partners.

Originally published in July 2023.

Highlights

- Institutional investors continue to debate whether the Federal Reserve is nearing a policy inflection point amid a confluence of slowing economic growth, rising inflation, and emerging financial market risks, which has been exemplified by volatility in the federal funds futures market.

- As interest rates serve as the foundational discounting mechanism for asset prices, Fidelity’s Target Date Investment Team believes a Fulcrum issue for multi-asset investors is assessing the interest rate expectations embedded across asset classes and how the current environment compares to other policy inflection points.

- In this paper, Fidelity’s Target Date Investment Team presents an historical analysis of short-term interest-rate futures—measured by the Eurodollar futures market—which the team extends to other asset classes to assess the path for short-term interest rates that is reflected by them.

- In their active allocation process, Fidelity’s Target Date Investment Team seeks to identify gaps in expectations across asset classes and this analysis serves as a way of triangulating the risk/reward opportunities around them, while drawing comparisons to history.

- The team finds the expectations reflected across assets today have some divergences from historical episodes, likely due to monetary regimes' post-global financial crisis and the unique aspects of having a world emerge from the COVID-19 pandemic.

- The conclusions from their analysis help build Fidelity’s Target Date Investment Team’s conviction in positioning the target date portfolios toward non-U.S. assets relative to the U.S. and leave them cautious on credit at this point in the market cycle.

Source: U.S. Bureau of Labor Statistics, Federal Reserve Board, as of March 31, 2023. Past performance is no guarantee of future results.