Outlook: Five forces that could shape markets in 2026

Fidelity’s Asset Allocation Research Team outlines key investment risks and opportunities for the year ahead.

Originally published in November 2025 by our U.S. partners.

Written by Dirk Hofschire, Director of Asset Allocation Research, and Jake Weinstein, SVP, Asset Allocation Research

Highlights

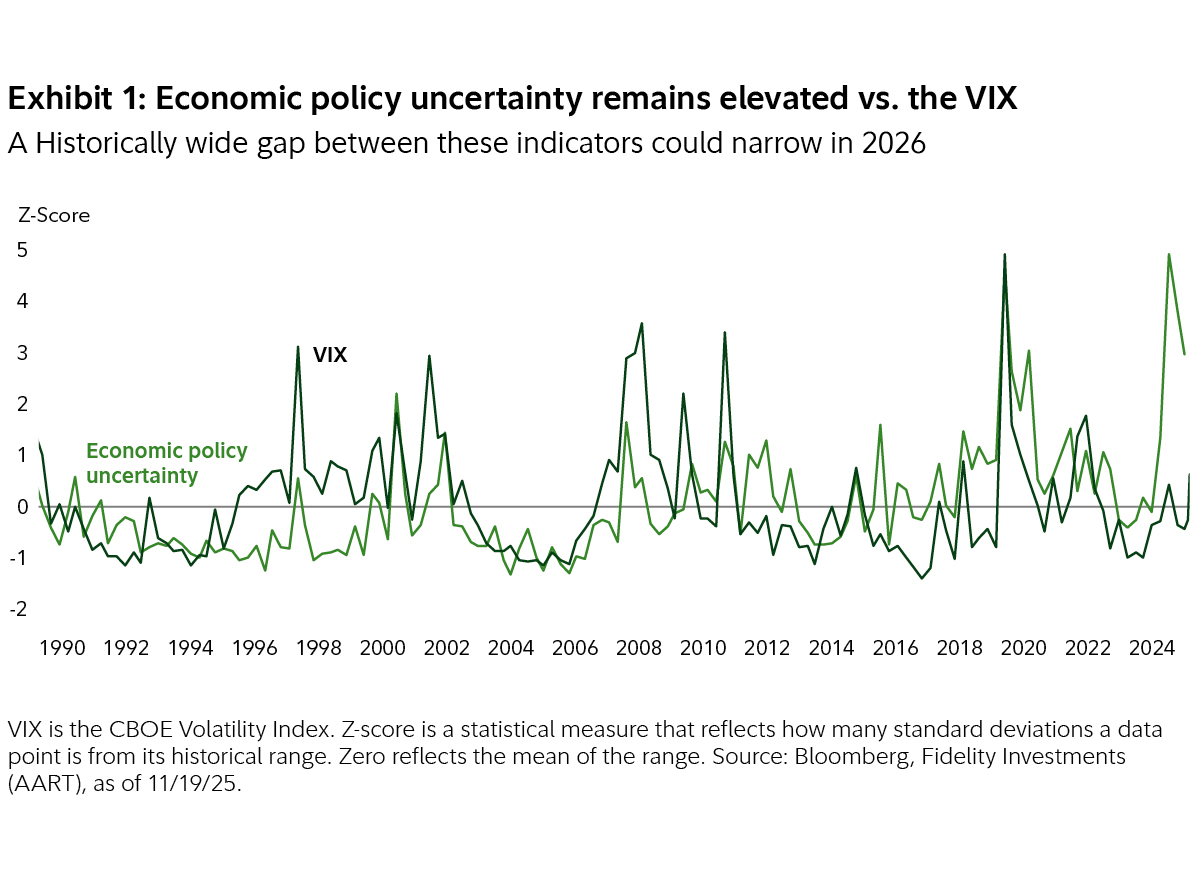

- A historically wide gap between policy uncertainty and subdued market volatility may narrow in 2026.

- Attractive valuations of non-U.S. currencies and other structural factors may support the relative outperformance of non-U.S. equities.

- The Fed may find itself on the hot seat, as persistent inflation and high government debt complicate monetary policy.

- AI-driven capital spending and favorable fiscal policy could continue to support the health of the U.S. business sector over the coming year.

- With wealth playing a larger role in consumption than it has historically, asset-price changes might have a greater impact on economic growth than in the past.