Fidelity aims to deliver investment solutions that leverage our global research expertise and local presence in key markets.

We focus on identifying opportunities that offer stable earnings growth through an investment cycle.

The Fidelity equity advantage

Our goal is to deliver strong and consistent investment performance to help clients achieve their investment objectives.

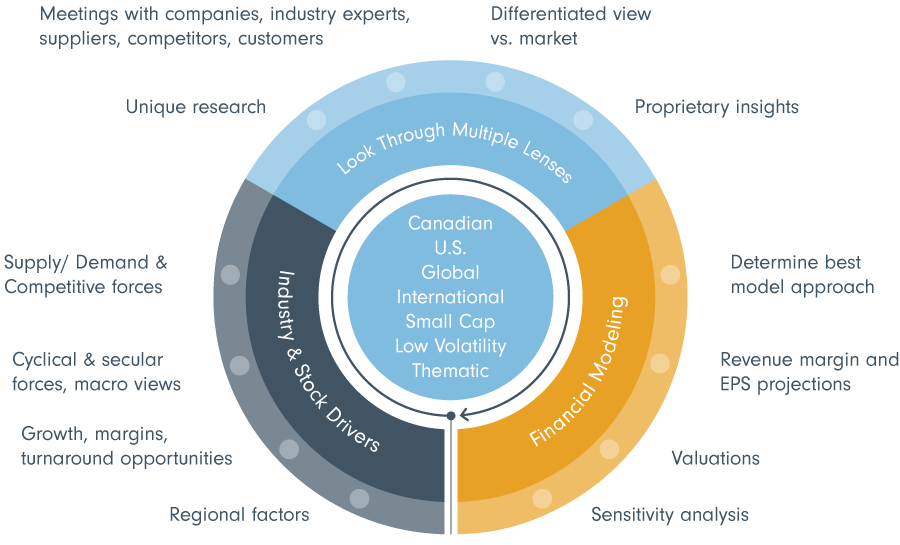

Unsurpassed research capabilities

Portfolio construction and proprietary risk management

A flexible and thorough research process provides a differentiated view

Idea generation is combined with active management and risk controls to construct portfolios that focus on delivering risk adjusted results.

Equity Investment Solutions

-

Canadian

- Focused on delivering consistent excess returns with a proven and repeatable process

- Controls risk by targeting sector exposures similar to those of the S&P/TSX Capped Composite Index

- Delivers core Canadian equity exposure while seeking consistently low tracking error and high information ratio

- Focused on delivering consistent excess returns through a disciplined investment process informed by both proprietary fundamental and quantitative analysis

- Controls relative risk by generally maintaining super sector1 exposures in line with those of the S&P/TSX Capped Composite Index

- Delivers core Canadian equity exposure while seeking a consistently high information ratio

- Focused on delivering consistent excess returns with a proven and repeatable process

- Uses a bottom‑up, fundamental approach designed to deliver the Canadian equity research team’s best ideas

- Investments in individual securities will be conviction-weighted meaning the portfolio may have significantly different exposures than those of the S&P/TSX Capped Composite Index

- Seeks long‑term growth of capital, primarily through investments in the Canadian equity universe, while maintaining an overall risk profile that is lower than the market

- Distinctive and unique approach to low-volatility investing that uses insights from Fidelity’s fundamental research platform

- Utilizes quantitative investment tools with aim of maximizing returns while minimizing absolute risk

- Focused on delivering consistent returns by investing in quality companies while limiting downside risk

- Selects stocks offering the best risk/reward profile relative to the current market cycle.

- Delivers core Canadian equity exposure, holding securities that demonstrate attractive valuations, generate strong cash flows and have solid balance sheets

Number of stocks: 80-100

Number of stocks: 40-80

1 The Standard and Poor’s super sectors are categorized as follows:

Consumer = Discretionary, Staples, Health Care

Industrials = Industrials, Information Technology

Resources = Energy, Materials

Interest Rate-Sensitive = Financials, Telecommunication Services, UtilitiesNumber of stocks: 40-80

Target Volatility: 60%-80% of S&P/TSX Capped Composite

Number of stocks: Approximately 60-90

Number of holdings: 50–100

-

U.S.

- Aims to provide annualized excess returns relative to the Russell 1000 Growth Index over a full market cycle

- Aims to provide annualized excess returns relative to the ICE BofA US High Yield Constrained Index over a full market cycle

- Aims to provide annualized excess returns relative to the Russell 3000 Value Index over a full market cycle

- Offers exposure to a diversified portfolio of U.S. large-cap equities

- Aims to provide annualized excess returns relative to the S&P 500 over a full market cycle

- Uses a bottom-up, fundamental strategy designed to deliver the best ideas from Fidelity’s extensive research capabilities

- Controls risk by generally maintaining sector exposures in line with those of the benchmark

Seeks to invest in a concentrated portfolio of non-cyclical companies that have the potential to deliver a high return on capital

Actively managed and high-conviction portfolio with a focus on downside mitigation

Uses a bottom-up, fundamental approach designed to deliver the best ideas from Fidelity’s extensive research capabilities

- Invests in a diversified portfolio of U.S. small-cap equities

- Aims to provide annualized excess returns relative to the Russell 2000 Index over a full market cycle

- Constructed to have similar characteristics and sector weights as the benchmark while added value is primarily sought through stock selection

- Invests in a diversified portfolio of U.S. small-cap equities with superior growth and financial characteristics that have valuations close to or below market valuations

- Aims to provide annualized excess returns relative to the Russell 2000 Index over a full market cycle

- Concentrated U.S. small-/mid-cap strategy

- Actively managed and high-conviction portfolio

- Compelling opportunity for alpha generation with a strong focus on downside protection

- Seeks long‑term growth of capital, primarily through investments in the U.S. equity universe, while maintaining an overall risk profile that is lower than the market

- Distinctive and unique approach to low-volatility investing that uses insights from Fidelity’s fundamental research platform that maintains coverage of over 3,100 companies

- Utilizes quantitative investment tools with aim of maximizing returns while minimizing absolute risk

Number of stocks: 75-125

Number of stocks: 30-50

Number of stocks: 150-250

Number of stocks: 150-200

Number of stocks: 30-50

Target Volatility: 60%-80% of S&P 500

Number of stocks: Approximately 150

-

Global

- Aims to provide annualized excess returns relative to the MSCI AC World Index over a full market cycle

- Aims to provide annualized excess returns relative to the MSCI EAFE + Emerging Markets Index (Net) Index over a full market cycle

- A broadly diversified portfolio that seeks to deliver value-added performance

- Investment universe is comprised of stocks in North America, Japan, the U.K., Europe (ex U.K.) and Asia Pacific (ex Japan)

- Utilizes a disciplined investment approach that combines qualitative stock selection with quantitative risk control

- Long-tenured investment team with uncommon insight into international markets

- A broadly diversified portfolio that seeks to deliver value-added performance

- Investment universe is comprised of stocks in North America, Japan, the U.K., Europe (ex U.K.), Asia Pacific (ex Japan) and emerging markets

- Utilizes a disciplined investment approach that combines qualitative stock selection with quantitative risk control

- Long-tenured investment team with uncommon insight into international markets

- An active and bottom-up core strategy that combines fundamental stock research with superior risk management

- Aims to provide annualized excess returns relative to the S&P Developed Small Cap Index over a full market cycle

- Designed around belief that global small-cap is an inefficient and under-covered asset class that offers opportunities to invest in equities at a significant discount to their long-term fundamental fair value

- Offers a consistent investment approach - managed by the same portfolio manager since the strategy’s inception in 2007

- An active and bottom-up core strategy that combines our fundamental stock research with superior risk management

- Aims to provide annualized excess returns relative to the MSCI AC World Small Cap Index over a full market cycle

- Designed around belief that global small-cap is an inefficient and under-covered asset class that offers opportunities to invest in global equities at a significant discount to their long-term fundamental fair value

- Offers a consistent investment approach- managed by the same portfolio manager since the strategy’s inception in 2008

- An active and bottom-up core strategy that is concentrated and based on high‑conviction investment ideas

- “Go anywhere” mandate with broad investment parameters to allow for portfolio flexibility across countries, sectors and industries

- Seeks to add value via stock selection in companies with predictable, durable and growing businesses

- Concentrated global portfolio that seeks to consistently deliver value-added performance by combining qualitative stock selection with quantitative risk management

- Aims to provide annualized excess returns relative to the S&P EPAC Small Cap Index over a full market cycle

- Offers a consistent investment approach- managed by the same portfolio management team since the strategy’s inception in 2009

- Seeks long‑term growth of capital, primarily through investments in the global developed equity universe, while maintaining an overall risk profile that is lower than the market

- Distinctive and unique approach to low-volatility investing that uses insights from Fidelity’s fundamental research platform that maintains coverage of over 3,100 companies

- Utilizes quantitative investment tools with aim of maximizing returns while minimizing absolute risk

- A flexible and unconstrained global approach that seeks long-term growth opportunities in special situations

- Aims to invest in high-quality businesses, undervalued securities and companies undergoing positive change

- Highly experienced portfolio manager with 25+ years running global equity portfolios

- A high-conviction portfolio that aims to deliver long-term capital growth by investing in equity securities of companies throughout the world

- Powered by the full breadth and depth of Fidelity International’s proprietary research network

- Rigorous, consistent and repeatable investment process – underpinned by independent risk management and controls

- Customizable to specific client requirements and bespoke mandates

- A high-conviction portfolio that aims to deliver long-term capital growth by investing in equity securities of companies in the developed world

- Powered by the full breadth and depth of Fidelity International’s proprietary research network

- Rigorous, consistent and repeatable investment process – underpinned by independent risk management and controls

- Customizable to specific client requirements and bespoke mandates

- Aims to deliver long-term, above-market performance over a business cycle with relatively low volatility

- Aims to provide investors with an attractive total return comprised of a healthy and sustainable dividend yield with income growth to protect against inflation

- Invests in high-quality companies with stable and/or improving returns on capital at reasonable valuation

- A diversified, global equity mandate generating long-term capital growth

- A high conviction portfolio of uncorrelated securities, the primary source of out-performance being stock selection

- Seeks to invest in companies with sustainable pricing power

- Alpha delivery across cycle, region and sector with low turnover

Number of stocks: 400-500

Number of stocks: 325-425

Number of stocks: 400-500

Number of stocks: Approximately 225

Number of stocks: Approximately 225

Number of stocks: Approximately 50

Number of stocks: 60-90

Target Volatility: 60%-80% of MSCI World ex. Canada

Number of stocks: Approximately 150

Number of stocks: 70-110

Number of stocks: 75-85

Number of stocks: 75-85

Number of stocks: 40-60

Number of stocks: 80-120

-

International

- Invests in a portfolio of high quality companies, looking for core international equity exposure

- Aims to provide annualized excess returns relative to the MSCI EAFE Index over a full market cycle

- Invests in growth opportunities around the world, looking for core international equity exposure

- Aims to provide annualized excess returns relative to the MSCI EAFE (N) Index over a full market cycle

- A broadly diversified portfolio that seeks to deliver value-added performance through a disciplined investment approach that combines qualitative stock selection with quantitative risk control

- Investment universe is comprised of stocks in Japan, the U.K., Europe (ex U.K.) and Asia Pacific (ex Japan)

- Offers a consistent investment approach-, managed by the same portfolio manager since the strategy’s inception in 1989

- A broadly diversified portfolio that seeks to deliver value-added performance through a disciplined investment approach that combines qualitative stock selection with quantitative risk control

- Investment universe is comprised of stocks in Japan, the U.K., Europe (ex U.K.), Asia Pacific (ex Japan) and emerging markets

- Offers a consistent investment approach - the Select international investment process has been implemented in developed markets since 1989 and extended to emerging markets in 2008

- Invests in large-, medium-, and small-cap companies in Europe, Japan and the Pacific Basin

- Investment approach is growth oriented, concentrating on companies with above-average earnings growth and attractive valuations

- A broadly diversified portfolio that seeks to deliver value-added performance with a disciplined investment approach that combines qualitative stock selection with quantitative risk control

- Aims to provide annualized excess returns relative to the S&P Developed ex US SmallCap Index (Net) over a full market cycle

- Designed around belief that international small-cap is an inefficient and under-covered asset class that offers opportunities to invest in international equities at a significant discount to their long-term fundamental fair value

- A broadly diversified portfolio that seeks to deliver value-added performance with a disciplined investment approach that combines qualitative stock selection with quantitative risk control

- Aims to provide annualized excess returns relative to the MSCI ACWI ex US Small Cap Index over a full market cycle

- Designed around belief that international small-cap is an inefficient and under-covered asset class that offers opportunities to invest in international equities at a significant discount to their long-term fundamental fair value

- Concentrated portfolio that aims to provide annualized excess returns relative to the S&P EPAC Small Cap Index over a full market cycle

- Utilizes a disciplined investment approach that combines qualitative stock selection with quantitative risk control

- Offers a consistent investment approach - managed by the same portfolio management team since the strategy’s inception in 2006

- Seeks long term growth of capital, primarily through investments in international equity securities (ex U.S.), while maintaining an overall risk profile that is lower than the market

- Distinctive and unique approach to low-volatility investing that uses insights from Fidelity’s fundamental research platform that maintains coverage of over 3,100 companies

- Utilizes quantitative investment tools with aim of maximizing returns while minimizing absolute risk

- Seeks to achieve consistent, repeatable alpha through stock selection, our core competency

- Aims to provide annualized excess returns relative to the MSCI Emerging Markets IMI Index over a full market cycle

- Aims to provide excess returns relative to the MSCI Emerging Markets® Index (Net) while maintaining similar fundamental characteristics

- Investment universe is comprised of emerging markets equities considered attractive by the analysts

- Utilizes a disciplined investment approach that combines qualitative stock selection with quantitative risk control

- Seeks to capture investment opportunities by exploiting inefficiencies of the emerging small-cap asset class

- Fundamental and proprietary quantitative models form insights across disciplines and identify value where mono-disciplinary approaches may not

- Consistent process since inception via a team that offers 16 years of history across all types of investment markets

- Invests in a concentrated portfolio of companies that benefit from solid foundations of robust corporate governance and capital structure, which are may be able to generate attractive returns for shareholders from their existing operations and future investment opportunities

- Selected stocks are held for the longer term in order to take best advantage of the growth opportunities they provide

- The portfolio is built on an absolute basis from the bottom up with little reference made to the structure of the applicable market index

- Seeks long‑term capital growth, primarily through investments in the EAFE equity universe, while maintaining an overall risk profile that is lower than the market

- Distinctive and unique approach to low-volatility investing that uses insights from Fidelity’s fundamental research platform

- Utilizes quantitative investment tools with the aim of maximizing returns while minimizing absolute risk

Number of stocks: 100-175

Number of stocks: 100-125

Number of stocks: 200-250

Number of stocks: 300-400

Number of stocks: 150-200

Number of stocks: 175-225

Number of stocks: 60-90

Target Volatility: 60%-80% of MSCI All Country ex-US Index

Number of stocks: Approximately 150

Number of stocks: 175-250

Number of stocks: 80-125

Number of stocks: Approximately 125

Number of stocks: 30-50

Target Volatility: 60%-80% MSCI EAFE

Number of stocks: Approximately 150

-

Small Cap

- Invests in a diversified portfolio of U.S. small-cap equities

- Aims to provide annualized excess returns relative to the Russell 2000 Index over a full market cycle

- Constructed to have similar characteristics and sector weights as the benchmark while added value is primarily sought through stock selection

- Invests in a diversified portfolio of U.S. small-cap equities with superior growth and financial characteristics that have valuations close to or below market valuations

- Aims to provide annualized excess returns relative to the Russell 2000 Index over a full market cycle

- Concentrated U.S. small-/mid-cap strategy

- Actively managed and high-conviction portfolio

- Compelling opportunity for alpha generation with a strong focus on downside protection

- An active and bottom-up core strategy that combines fundamental stock research with superior risk management

- Aims to provide annualized excess returns relative to the S&P Developed Small Cap Index over a full market cycle

- Designed around belief that global small-cap is an inefficient and under-covered asset class that offers opportunities to invest in equities at a significant discount to their long-term fundamental fair value

- Offers a consistent investment approach - managed by the same portfolio manager since the strategy’s inception in 2007

- An active and bottom-up core strategy that combines fundamental stock research with superior risk management

- Aims to provide annualized excess returns relative to the S&P Developed Small Cap Index over a full market cycle

- Designed around belief that global small-cap is an inefficient and under-covered asset class that offers opportunities to invest in equities at a significant discount to their long-term fundamental fair value

- Offers a consistent investment approach - managed by the same portfolio manager since the strategy’s inception in 2007

- An active and bottom-up core strategy that combines our fundamental stock research with superior risk management

- Aims to provide annualized excess returns relative to the MSCI AC World Small Cap Index over a full market cycle

- Designed around belief that global small-cap is an inefficient and under-covered asset class that offers opportunities to invest in global equities at a significant discount to their long-term fundamental fair value

- Offers a consistent investment approach- managed by the same portfolio manager since the strategy’s inception in 2008

- Concentrated global portfolio that seeks to consistently deliver value-added performance by combining qualitative stock selection with quantitative risk management

- Aims to provide annualized excess returns relative to the S&P EPAC Small Cap Index over a full market cycle

- Offers a consistent investment approach- managed by the same portfolio management team since the strategy’s inception in 2009

- A broadly diversified portfolio that seeks to deliver value-added performance with a disciplined investment approach that combines qualitative stock selection with quantitative risk control

- Aims to provide annualized excess returns relative to the S&P Developed ex US SmallCap Index (Net) over a full market cycle

- Designed around belief that international small-cap is an inefficient and under-covered asset class that offers opportunities to invest in international equities at a significant discount to their long-term fundamental fair value

- A broadly diversified portfolio that seeks to deliver value-added performance with a disciplined investment approach that combines qualitative stock selection with quantitative risk control

- Aims to provide annualized excess returns relative to the MSCI ACWI ex US Small Cap Index over a full market cycle

- Designed around belief that international small-cap is an inefficient and under-covered asset class that offers opportunities to invest in international equities at a significant discount to their long-term fundamental fair value

- Concentrated portfolio that aims to provide annualized excess returns relative to the S&P EPAC Small Cap Index over a full market cycle

- Utilizes a disciplined investment approach that combines qualitative stock selection with quantitative risk control

- Offers a consistent investment approach - managed by the same portfolio management team since the strategy’s inception in 2006

- Seeks to capture investment opportunities by exploiting inefficiencies of the emerging small-cap asset class

- Fundamental and proprietary quantitative models form insights across disciplines and identify value where mono-disciplinary approaches may not

- Consistent process since inception via a team that offers 16 years of history across all types of investment markets

Number of stocks: 150-250

Number of stocks: 150-200

Number of stocks: 30-50

Number of stocks: Approximately 225

Number of stocks: Approximately 225

Number of stocks: Approximately 225

Number of stocks: 60-90

Number of stocks: 150-200

Number of stocks: 175-225

Number of stocks: 60-90

Number of stocks: Approximately 125

-

Low Volatility

- Seeks long‑term growth of capital, primarily through investments in the Canadian equity universe, while maintaining an overall risk profile that is lower than the market

- Distinctive and unique approach to low-volatility investing that uses insights from Fidelity’s fundamental research platform

- Utilizes quantitative investment tools with aim of maximizing returns while minimizing absolute risk

- Seeks long‑term growth of capital, primarily through investments in the U.S. equity universe, while maintaining an overall risk profile that is lower than the market

- Distinctive and unique approach to low-volatility investing that uses insights from Fidelity’s fundamental research platform that maintains coverage of over 3,100 companies

- Utilizes quantitative investment tools with aim of maximizing returns while minimizing absolute risk

- Seeks long‑term growth of capital, primarily through investments in the global developed equity universe, while maintaining an overall risk profile that is lower than the market

- Distinctive and unique approach to low-volatility investing that uses insights from Fidelity’s fundamental research platform that maintains coverage of over 3,100 companies

- Utilizes quantitative investment tools with aim of maximizing returns while minimizing absolute risk

- Seeks long term growth of capital, primarily through investments in international equity securities (ex U.S.), while maintaining an overall risk profile that is lower than the market

- Distinctive and unique approach to low-volatility investing that uses insights from Fidelity’s fundamental research platform that maintains coverage of over 3,100 companies

- Utilizes quantitative investment tools with aim of maximizing returns while minimizing absolute risk

- Seeks long‑term capital growth, primarily through investments in the EAFE equity universe, while maintaining an overall risk profile that is lower than the market

- Distinctive and unique approach to low-volatility investing that uses insights from Fidelity’s fundamental research platform

- Utilizes quantitative investment tools with the aim of maximizing returns while minimizing absolute risk

Target Volatility: 60-80% of S&P/TSX Capped Composite

Number of stocks: Approximately 60-90

Target Volatility: 60%-80% of Russell 3000 Index

Number of stocks: Approximately 150

Target Volatility: 60%-80% of MSCI World ex. Canada

Number of stocks: Approximately 150

Target Volatility: 60%-80% of MSCI All Country ex-US Index

Number of stocks: Approximately 150

Target Volatility: 60%-80% MSCI EAFE

Number of stocks: Approximately 150

-

Thematic

- Looks to invest in a concentrated portfolio of companies that are able to benefit from demographic trends, including ageing, the growth of the middle classes and population growth

- Utilizes an unconstrained approach to portfolio construction, with investment based on a company’s merits irrespective of its prominence in the market index

- May use derivatives with the aim of risk or cost reduction or to generate additional capital or income, in line with the portfolio’s risk profile.

- Provides investors with real estate exposure across the core Eurozone markets of Germany, France and the Benelux

- Aims to deliver superior returns with low volatility by investing in a diversified and high-quality portfolio of properties with strong fundamentals

- Unique investment strategy built on the ability to combine bottom-up asset selection with sophisticated analysis of tenant income and market research

Number of stocks: 50-70

-

- Focused on delivering consistent excess returns with a proven and repeatable process

- Controls risk by targeting sector exposures similar to those of the S&P/TSX Capped Composite Index

- Delivers core Canadian equity exposure while seeking consistently low tracking error and high information ratio

Number of stocks: 80-100

- Focused on delivering consistent excess returns through a disciplined investment process informed by both proprietary fundamental and quantitative analysis

- Controls relative risk by generally maintaining super sector1 exposures in line with those of the S&P/TSX Capped Composite Index

- Delivers core Canadian equity exposure while seeking a consistently high information ratio

Number of stocks: 40-80

1 The Standard and Poor’s super sectors are categorized as follows:

Consumer = Discretionary, Staples, Health Care

Industrials = Industrials, Information Technology

Resources = Energy, Materials

Interest Rate-Sensitive = Financials, Telecommunication Services, Utilities- Focused on delivering consistent excess returns with a proven and repeatable process

- Uses a bottom‑up, fundamental approach designed to deliver the Canadian equity research team’s best ideas

- Investments in individual securities will be conviction-weighted meaning the portfolio may have significantly different exposures than those of the S&P/TSX Capped Composite Index

Number of stocks: 40-80

- Seeks long‑term growth of capital, primarily through investments in the Canadian equity universe, while maintaining an overall risk profile that is lower than the market

- Distinctive and unique approach to low-volatility investing that uses insights from Fidelity’s fundamental research platform

- Utilizes quantitative investment tools with aim of maximizing returns while minimizing absolute risk

Target Volatility: 60%-80% of S&P/TSX Capped Composite

Number of stocks: Approximately 60-90

- Focused on delivering consistent returns by investing in quality companies while limiting downside risk

- Selects stocks offering the best risk/reward profile relative to the current market cycle.

- Delivers core Canadian equity exposure, holding securities that demonstrate attractive valuations, generate strong cash flows and have solid balance sheets

Number of holdings: 50–100

-

- Aims to provide annualized excess returns relative to the Russell 1000 Growth Index over a full market cycle

- Aims to provide annualized excess returns relative to the ICE BofA US High Yield Constrained Index over a full market cycle

- Aims to provide annualized excess returns relative to the Russell 3000 Value Index over a full market cycle

- Offers exposure to a diversified portfolio of U.S. large-cap equities

- Aims to provide annualized excess returns relative to the S&P 500 over a full market cycle

- Uses a bottom-up, fundamental strategy designed to deliver the best ideas from Fidelity’s extensive research capabilities

- Controls risk by generally maintaining sector exposures in line with those of the benchmark

Number of stocks: 75-125

Seeks to invest in a concentrated portfolio of non-cyclical companies that have the potential to deliver a high return on capital

Actively managed and high-conviction portfolio with a focus on downside mitigation

Uses a bottom-up, fundamental approach designed to deliver the best ideas from Fidelity’s extensive research capabilities

Number of stocks: 30-50

- Invests in a diversified portfolio of U.S. small-cap equities

- Aims to provide annualized excess returns relative to the Russell 2000 Index over a full market cycle

- Constructed to have similar characteristics and sector weights as the benchmark while added value is primarily sought through stock selection

Number of stocks: 150-250

- Invests in a diversified portfolio of U.S. small-cap equities with superior growth and financial characteristics that have valuations close to or below market valuations

- Aims to provide annualized excess returns relative to the Russell 2000 Index over a full market cycle

Number of stocks: 150-200

- Concentrated U.S. small-/mid-cap strategy

- Actively managed and high-conviction portfolio

- Compelling opportunity for alpha generation with a strong focus on downside protection

Number of stocks: 30-50

- Seeks long‑term growth of capital, primarily through investments in the U.S. equity universe, while maintaining an overall risk profile that is lower than the market

- Distinctive and unique approach to low-volatility investing that uses insights from Fidelity’s fundamental research platform that maintains coverage of over 3,100 companies

- Utilizes quantitative investment tools with aim of maximizing returns while minimizing absolute risk

Target Volatility: 60%-80% of S&P 500

Number of stocks: Approximately 150

-

- Aims to provide annualized excess returns relative to the MSCI AC World Index over a full market cycle

Number of stocks: 400-500

- Aims to provide annualized excess returns relative to the MSCI EAFE + Emerging Markets Index (Net) Index over a full market cycle

- A broadly diversified portfolio that seeks to deliver value-added performance

- Investment universe is comprised of stocks in North America, Japan, the U.K., Europe (ex U.K.) and Asia Pacific (ex Japan)

- Utilizes a disciplined investment approach that combines qualitative stock selection with quantitative risk control

- Long-tenured investment team with uncommon insight into international markets

Number of stocks: 325-425

- A broadly diversified portfolio that seeks to deliver value-added performance

- Investment universe is comprised of stocks in North America, Japan, the U.K., Europe (ex U.K.), Asia Pacific (ex Japan) and emerging markets

- Utilizes a disciplined investment approach that combines qualitative stock selection with quantitative risk control

- Long-tenured investment team with uncommon insight into international markets

Number of stocks: 400-500

- An active and bottom-up core strategy that combines fundamental stock research with superior risk management

- Aims to provide annualized excess returns relative to the S&P Developed Small Cap Index over a full market cycle

- Designed around belief that global small-cap is an inefficient and under-covered asset class that offers opportunities to invest in equities at a significant discount to their long-term fundamental fair value

- Offers a consistent investment approach - managed by the same portfolio manager since the strategy’s inception in 2007

Number of stocks: Approximately 225

- An active and bottom-up core strategy that combines our fundamental stock research with superior risk management

- Aims to provide annualized excess returns relative to the MSCI AC World Small Cap Index over a full market cycle

- Designed around belief that global small-cap is an inefficient and under-covered asset class that offers opportunities to invest in global equities at a significant discount to their long-term fundamental fair value

- Offers a consistent investment approach- managed by the same portfolio manager since the strategy’s inception in 2008

Number of stocks: Approximately 225

- An active and bottom-up core strategy that is concentrated and based on high‑conviction investment ideas

- “Go anywhere” mandate with broad investment parameters to allow for portfolio flexibility across countries, sectors and industries

- Seeks to add value via stock selection in companies with predictable, durable and growing businesses

Number of stocks: Approximately 50

- Concentrated global portfolio that seeks to consistently deliver value-added performance by combining qualitative stock selection with quantitative risk management

- Aims to provide annualized excess returns relative to the S&P EPAC Small Cap Index over a full market cycle

- Offers a consistent investment approach- managed by the same portfolio management team since the strategy’s inception in 2009

Number of stocks: 60-90

- Seeks long‑term growth of capital, primarily through investments in the global developed equity universe, while maintaining an overall risk profile that is lower than the market

- Distinctive and unique approach to low-volatility investing that uses insights from Fidelity’s fundamental research platform that maintains coverage of over 3,100 companies

- Utilizes quantitative investment tools with aim of maximizing returns while minimizing absolute risk

Target Volatility: 60%-80% of MSCI World ex. Canada

Number of stocks: Approximately 150

- A flexible and unconstrained global approach that seeks long-term growth opportunities in special situations

- Aims to invest in high-quality businesses, undervalued securities and companies undergoing positive change

- Highly experienced portfolio manager with 25+ years running global equity portfolios

Number of stocks: 70-110

- A high-conviction portfolio that aims to deliver long-term capital growth by investing in equity securities of companies throughout the world

- Powered by the full breadth and depth of Fidelity International’s proprietary research network

- Rigorous, consistent and repeatable investment process – underpinned by independent risk management and controls

- Customizable to specific client requirements and bespoke mandates

Number of stocks: 75-85

- A high-conviction portfolio that aims to deliver long-term capital growth by investing in equity securities of companies in the developed world

- Powered by the full breadth and depth of Fidelity International’s proprietary research network

- Rigorous, consistent and repeatable investment process – underpinned by independent risk management and controls

- Customizable to specific client requirements and bespoke mandates

Number of stocks: 75-85

- Aims to deliver long-term, above-market performance over a business cycle with relatively low volatility

- Aims to provide investors with an attractive total return comprised of a healthy and sustainable dividend yield with income growth to protect against inflation

- Invests in high-quality companies with stable and/or improving returns on capital at reasonable valuation

Number of stocks: 40-60

- A diversified, global equity mandate generating long-term capital growth

- A high conviction portfolio of uncorrelated securities, the primary source of out-performance being stock selection

- Seeks to invest in companies with sustainable pricing power

- Alpha delivery across cycle, region and sector with low turnover

Number of stocks: 80-120

-

- Invests in a portfolio of high quality companies, looking for core international equity exposure

- Aims to provide annualized excess returns relative to the MSCI EAFE Index over a full market cycle

Number of stocks: 100-175

- Invests in growth opportunities around the world, looking for core international equity exposure

- Aims to provide annualized excess returns relative to the MSCI EAFE (N) Index over a full market cycle

Number of stocks: 100-125

- A broadly diversified portfolio that seeks to deliver value-added performance through a disciplined investment approach that combines qualitative stock selection with quantitative risk control

- Investment universe is comprised of stocks in Japan, the U.K., Europe (ex U.K.) and Asia Pacific (ex Japan)

- Offers a consistent investment approach-, managed by the same portfolio manager since the strategy’s inception in 1989

Number of stocks: 200-250

- A broadly diversified portfolio that seeks to deliver value-added performance through a disciplined investment approach that combines qualitative stock selection with quantitative risk control

- Investment universe is comprised of stocks in Japan, the U.K., Europe (ex U.K.), Asia Pacific (ex Japan) and emerging markets

- Offers a consistent investment approach - the Select international investment process has been implemented in developed markets since 1989 and extended to emerging markets in 2008

Number of stocks: 300-400

- Invests in large-, medium-, and small-cap companies in Europe, Japan and the Pacific Basin

- Investment approach is growth oriented, concentrating on companies with above-average earnings growth and attractive valuations

- A broadly diversified portfolio that seeks to deliver value-added performance with a disciplined investment approach that combines qualitative stock selection with quantitative risk control

- Aims to provide annualized excess returns relative to the S&P Developed ex US SmallCap Index (Net) over a full market cycle

- Designed around belief that international small-cap is an inefficient and under-covered asset class that offers opportunities to invest in international equities at a significant discount to their long-term fundamental fair value

Number of stocks: 150-200

- A broadly diversified portfolio that seeks to deliver value-added performance with a disciplined investment approach that combines qualitative stock selection with quantitative risk control

- Aims to provide annualized excess returns relative to the MSCI ACWI ex US Small Cap Index over a full market cycle

- Designed around belief that international small-cap is an inefficient and under-covered asset class that offers opportunities to invest in international equities at a significant discount to their long-term fundamental fair value

Number of stocks: 175-225

- Concentrated portfolio that aims to provide annualized excess returns relative to the S&P EPAC Small Cap Index over a full market cycle

- Utilizes a disciplined investment approach that combines qualitative stock selection with quantitative risk control

- Offers a consistent investment approach - managed by the same portfolio management team since the strategy’s inception in 2006

Number of stocks: 60-90

- Seeks long term growth of capital, primarily through investments in international equity securities (ex U.S.), while maintaining an overall risk profile that is lower than the market

- Distinctive and unique approach to low-volatility investing that uses insights from Fidelity’s fundamental research platform that maintains coverage of over 3,100 companies

- Utilizes quantitative investment tools with aim of maximizing returns while minimizing absolute risk

Target Volatility: 60%-80% of MSCI All Country ex-US Index

Number of stocks: Approximately 150

- Seeks to achieve consistent, repeatable alpha through stock selection, our core competency

- Aims to provide annualized excess returns relative to the MSCI Emerging Markets IMI Index over a full market cycle

Number of stocks: 175-250

- Aims to provide excess returns relative to the MSCI Emerging Markets® Index (Net) while maintaining similar fundamental characteristics

- Investment universe is comprised of emerging markets equities considered attractive by the analysts

- Utilizes a disciplined investment approach that combines qualitative stock selection with quantitative risk control

Number of stocks: 80-125

- Seeks to capture investment opportunities by exploiting inefficiencies of the emerging small-cap asset class

- Fundamental and proprietary quantitative models form insights across disciplines and identify value where mono-disciplinary approaches may not

- Consistent process since inception via a team that offers 16 years of history across all types of investment markets

Number of stocks: Approximately 125

- Invests in a concentrated portfolio of companies that benefit from solid foundations of robust corporate governance and capital structure, which are may be able to generate attractive returns for shareholders from their existing operations and future investment opportunities

- Selected stocks are held for the longer term in order to take best advantage of the growth opportunities they provide

- The portfolio is built on an absolute basis from the bottom up with little reference made to the structure of the applicable market index

Number of stocks: 30-50

- Seeks long‑term capital growth, primarily through investments in the EAFE equity universe, while maintaining an overall risk profile that is lower than the market

- Distinctive and unique approach to low-volatility investing that uses insights from Fidelity’s fundamental research platform

- Utilizes quantitative investment tools with the aim of maximizing returns while minimizing absolute risk

Target Volatility: 60%-80% MSCI EAFE

Number of stocks: Approximately 150

-

- Invests in a diversified portfolio of U.S. small-cap equities

- Aims to provide annualized excess returns relative to the Russell 2000 Index over a full market cycle

- Constructed to have similar characteristics and sector weights as the benchmark while added value is primarily sought through stock selection

Number of stocks: 150-250

- Invests in a diversified portfolio of U.S. small-cap equities with superior growth and financial characteristics that have valuations close to or below market valuations

- Aims to provide annualized excess returns relative to the Russell 2000 Index over a full market cycle

Number of stocks: 150-200

- Concentrated U.S. small-/mid-cap strategy

- Actively managed and high-conviction portfolio

- Compelling opportunity for alpha generation with a strong focus on downside protection

Number of stocks: 30-50

- An active and bottom-up core strategy that combines fundamental stock research with superior risk management

- Aims to provide annualized excess returns relative to the S&P Developed Small Cap Index over a full market cycle

- Designed around belief that global small-cap is an inefficient and under-covered asset class that offers opportunities to invest in equities at a significant discount to their long-term fundamental fair value

- Offers a consistent investment approach - managed by the same portfolio manager since the strategy’s inception in 2007

Number of stocks: Approximately 225

- An active and bottom-up core strategy that combines fundamental stock research with superior risk management

- Aims to provide annualized excess returns relative to the S&P Developed Small Cap Index over a full market cycle

- Designed around belief that global small-cap is an inefficient and under-covered asset class that offers opportunities to invest in equities at a significant discount to their long-term fundamental fair value

- Offers a consistent investment approach - managed by the same portfolio manager since the strategy’s inception in 2007

Number of stocks: Approximately 225

- An active and bottom-up core strategy that combines our fundamental stock research with superior risk management

- Aims to provide annualized excess returns relative to the MSCI AC World Small Cap Index over a full market cycle

- Designed around belief that global small-cap is an inefficient and under-covered asset class that offers opportunities to invest in global equities at a significant discount to their long-term fundamental fair value

- Offers a consistent investment approach- managed by the same portfolio manager since the strategy’s inception in 2008

Number of stocks: Approximately 225

- Concentrated global portfolio that seeks to consistently deliver value-added performance by combining qualitative stock selection with quantitative risk management

- Aims to provide annualized excess returns relative to the S&P EPAC Small Cap Index over a full market cycle

- Offers a consistent investment approach- managed by the same portfolio management team since the strategy’s inception in 2009

Number of stocks: 60-90

- A broadly diversified portfolio that seeks to deliver value-added performance with a disciplined investment approach that combines qualitative stock selection with quantitative risk control

- Aims to provide annualized excess returns relative to the S&P Developed ex US SmallCap Index (Net) over a full market cycle

- Designed around belief that international small-cap is an inefficient and under-covered asset class that offers opportunities to invest in international equities at a significant discount to their long-term fundamental fair value

Number of stocks: 150-200

- A broadly diversified portfolio that seeks to deliver value-added performance with a disciplined investment approach that combines qualitative stock selection with quantitative risk control

- Aims to provide annualized excess returns relative to the MSCI ACWI ex US Small Cap Index over a full market cycle

- Designed around belief that international small-cap is an inefficient and under-covered asset class that offers opportunities to invest in international equities at a significant discount to their long-term fundamental fair value

Number of stocks: 175-225

- Concentrated portfolio that aims to provide annualized excess returns relative to the S&P EPAC Small Cap Index over a full market cycle

- Utilizes a disciplined investment approach that combines qualitative stock selection with quantitative risk control

- Offers a consistent investment approach - managed by the same portfolio management team since the strategy’s inception in 2006

Number of stocks: 60-90

- Seeks to capture investment opportunities by exploiting inefficiencies of the emerging small-cap asset class

- Fundamental and proprietary quantitative models form insights across disciplines and identify value where mono-disciplinary approaches may not

- Consistent process since inception via a team that offers 16 years of history across all types of investment markets

Number of stocks: Approximately 125

-

- Seeks long‑term growth of capital, primarily through investments in the Canadian equity universe, while maintaining an overall risk profile that is lower than the market

- Distinctive and unique approach to low-volatility investing that uses insights from Fidelity’s fundamental research platform

- Utilizes quantitative investment tools with aim of maximizing returns while minimizing absolute risk

Target Volatility: 60-80% of S&P/TSX Capped Composite

Number of stocks: Approximately 60-90

- Seeks long‑term growth of capital, primarily through investments in the U.S. equity universe, while maintaining an overall risk profile that is lower than the market

- Distinctive and unique approach to low-volatility investing that uses insights from Fidelity’s fundamental research platform that maintains coverage of over 3,100 companies

- Utilizes quantitative investment tools with aim of maximizing returns while minimizing absolute risk

Target Volatility: 60%-80% of Russell 3000 Index

Number of stocks: Approximately 150

- Seeks long‑term growth of capital, primarily through investments in the global developed equity universe, while maintaining an overall risk profile that is lower than the market

- Distinctive and unique approach to low-volatility investing that uses insights from Fidelity’s fundamental research platform that maintains coverage of over 3,100 companies

- Utilizes quantitative investment tools with aim of maximizing returns while minimizing absolute risk

Target Volatility: 60%-80% of MSCI World ex. Canada

Number of stocks: Approximately 150

- Seeks long term growth of capital, primarily through investments in international equity securities (ex U.S.), while maintaining an overall risk profile that is lower than the market

- Distinctive and unique approach to low-volatility investing that uses insights from Fidelity’s fundamental research platform that maintains coverage of over 3,100 companies

- Utilizes quantitative investment tools with aim of maximizing returns while minimizing absolute risk

Target Volatility: 60%-80% of MSCI All Country ex-US Index

Number of stocks: Approximately 150

- Seeks long‑term capital growth, primarily through investments in the EAFE equity universe, while maintaining an overall risk profile that is lower than the market

- Distinctive and unique approach to low-volatility investing that uses insights from Fidelity’s fundamental research platform

- Utilizes quantitative investment tools with the aim of maximizing returns while minimizing absolute risk

Target Volatility: 60%-80% MSCI EAFE

Number of stocks: Approximately 150

-

- Looks to invest in a concentrated portfolio of companies that are able to benefit from demographic trends, including ageing, the growth of the middle classes and population growth

- Utilizes an unconstrained approach to portfolio construction, with investment based on a company’s merits irrespective of its prominence in the market index

- May use derivatives with the aim of risk or cost reduction or to generate additional capital or income, in line with the portfolio’s risk profile.

Number of stocks: 50-70

- Provides investors with real estate exposure across the core Eurozone markets of Germany, France and the Benelux

- Aims to deliver superior returns with low volatility by investing in a diversified and high-quality portfolio of properties with strong fundamentals

- Unique investment strategy built on the ability to combine bottom-up asset selection with sophisticated analysis of tenant income and market research

This information is designed to provide an indication of certain attributes of these strategies and is subject to change. For full details of the applicable mandates, including the investment objectives, please contact Fidelity Canada Institutional.

We offer a comprehensive lineup of institutional investment strategies and mutual funds available on all major recordkeeping platforms.

Meet the equity leadership team

Before joining Fidelity in 2013, Pam held a number of senior roles at Putnam Investments. She has been in the investments industry since 1986.

Before assuming this role, Tim held a number of senior roles at Fidelity and managed various diversified equity portfolios. He has been in the financial industry since joining Fidelity as a research analyst in 1996.

Mr. Marchese joined Fidelity in 1998 and has played a pivotal role in leading and building out Fidelity’s dedicated Canadian investment team. He has been in the investments industry since 1998.