Fidelity ClearPath Portfolios are designed to help Canadian investors solve the challenge of investing through retirement.

Our approach is powered by glide path design and a balanced approach to risk.

20 years of innovation

1 As at December 31, 2025, in Canadian dollars.

A retirement solution designed for Canadians

Fidelity ClearPath® Portfolios are designed for Canadian investors. Shaped by key drivers of long-term outcomes, our unique glide path reflects actual behaviours of Canadian plan members.

Glide path design is informed by research in three critical areas:

Designed for income

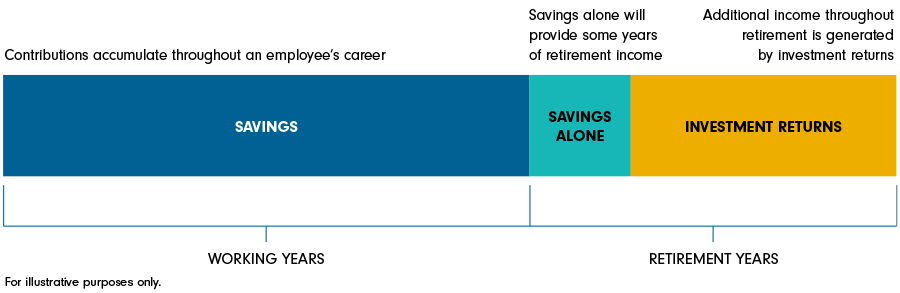

With many Canadians depending on defined contribution plans as their primary source of retirement income, plan sponsors can design their plans to target specific income replacement goals, helping members maintain their standard of living in retirement.

It is important to recognize that savings alone may not provide an adequate level of income replacement throughout a retirement that could last 25–30 years

Related content

Meet the investment team

Prior to assuming his current position in February 2019, Mr. Crocco was responsible for providing research support to the portfolio managers of Global Institutional Solutions (GIS) and U.S. and Canada Retail Solutions Groups. Additionally, Mr. Crocco was responsible for researching active asset allocation investment signals and disseminating his findings across GAA. Previously, Mr. Crocco was a manager in the Financial Markets Group where he was responsible for monitoring global financial markets for trends and risks that might impact Fidelity’s mutual funds and businesses.

He has been in the investments industry since joining Fidelity in 2010.

Before joining Fidelity in 2014, Mr. Sumsion held various positions at DuPont Capital Management, Inc., including that of managing director of asset allocation and portfolio manager. Previously, Mr. Sumsion worked at Strategis Financial Group, Inc., where he was chief executive officer and vice-president of asset allocation research. He has been in the investments industry since 2001.

Before joining Fidelity in 2004, Andrew worked as an actuary at CIGNA and held actuarial roles at Provident Mutual Life Insurance Company. He has been in the financial services industry since 1993.

Mr. Knowles joined Fidelity in 2016 as an associate in advisor sales. Before assuming his current position in August 2023, Mr. Knowles was a senior investment analyst at Fidelity Canada Institutional and was responsible for providing investment analysis and management of multi-asset solutions for institutional and retail investors.