US vs. European Real Estate: Why Europe is poised to outperform

Is negative sentiment to European real estate justified or is contagion from the US spreading?

Originally published in July 2023 by Fidelity International.

Written by Cian O’Sullivan, Senior Research Analyst - European Real Estate.

Highlights

- Rebased European values are close to trough

- The fundamentals highlight Europe’s relative strengths

- Europe is a global leader in flexible working

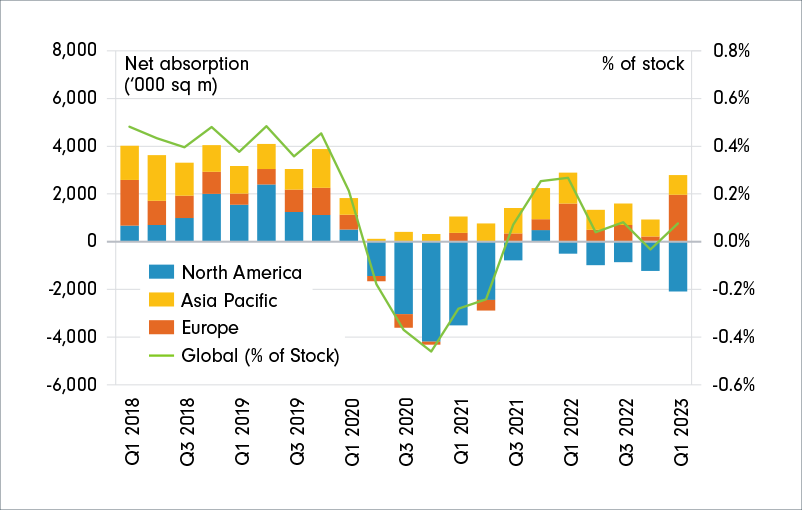

Net absorption of space

The latest trends on net absorption[1] illustrate that Europe is gaining strength each quarter, despite the challenging growth backdrop, as the number of leases being signed outweighs the amount of space coming back to the market and new supply coming on stream. The US occupier market is still following its post pandemic trend downwards however, as the combination of more development and weaker occupier demand take effect.

These trends suggest that the current differential in vacancy rates between the US and Europe will continue for another while yet, albeit some further weakening in occupier demand in both regions should be anticipated as Fidelity expects the US and European economies to enter a cyclical recession in the next 12 months.

[1] Net absorption is the sum of space that became physically occupied, minus the sum of space that became physically vacant during a specific period