Fidelity’s Target Date glide path: A research-driven approach

An effective target date strategy requires a glide path that provides diversification, embraces participants’ long-term investment horizons, and is supported by an adaptive investment process

Originally published in July 2023 by our U.S. partners.

Written by Andrew Dierdorf, CFA, Portfolio Manager, Global Asset Allocation, Brett Sumison, CFA, Portfolio Manager, Global Asset Allocation, Finola McGuire Foley, CFA, Portfolio Manager, Global Asset Allocation, The Strategic Asset Allocation Research Team, Global Asset Allocation

Highlights

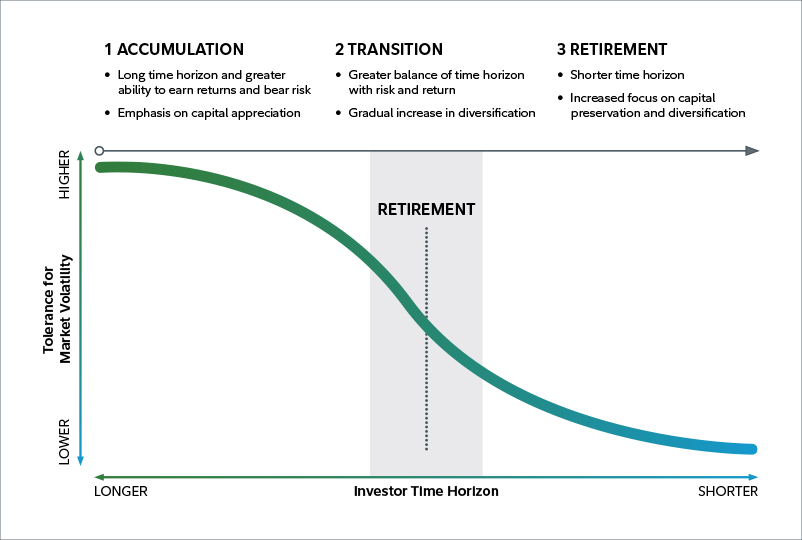

- A target date strategy’s glide path is a primary driver of participant outcomes and reflects an investment manager’s beliefs about strategic asset allocation, including asset class selection and the trade-offs between risk and return throughout participants’ evolving time horizons.

- Diversification is a core principle within Fidelity’s target date strategies, providing a balance among exposures in the portfolios to help navigate the uncertainty of capital markets over long-term time periods.

- Fidelity’s unique insights on the retirement goals and savings behaviors of a broad range of target date participants are central to understanding their needs and tolerance for risk.

- Fidelity’s glide path is supported by investment research that considers historical and forward-looking perspectives on capital markets.

- When constructing the glide path, we evaluate and synthesize research from multiple analytical frameworks to assess and balance the impact of various risks on retirement outcomes.