Manage-to-green: Sustainable opportunities in European logistics

Opting to renovate existing real estate logistics assets can help accelerate the decarbonization pathway of a real estate portfolio while improving risk-adjusted returns potential. Through our manage-to-green approach, we highlight how Fidelity International’s pan-European climate impact logistics strategy is tapping into this compelling opportunity.

Written by Adrian Benedict, Head of Real Estate Solutions, Fidelity International.

Marketing communication. Important information is available at the end of this page.

Key points

As sustainability has become more important for occupiers, the carbon footprint of their real estate facilities have naturally come to the fore. Reducing the environmental impact of buildings to meet upcoming ESG regulation and to increase asset value is now among the most important considerations for real estate investors.

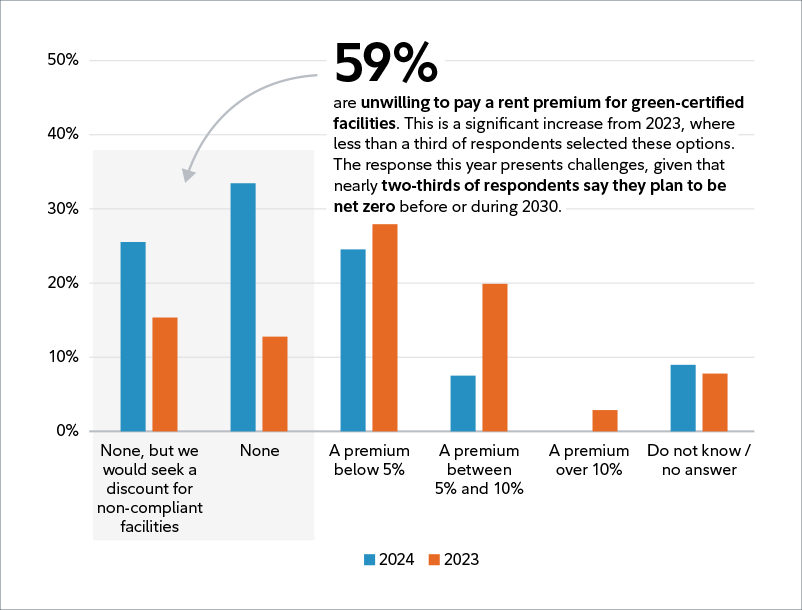

This is particularly true for logistics firms, in which transport and real estate account for a large proportion of the carbon footprints. Occupiers now expect to pay less rent for buildings that are not green-certified facilities, according to the CBRE European Logistics Occupier Survey 2024 (see Figure 1). In short, tenants want buildings that are set up to operate at net zero and as efficiently as possible to save on running costs and to meet sustainability goals.

Additionally, European regulatory initiatives such as the EU Taxonomy and the Sustainable Finance Disclosure Regulation (SFDR) will likely exert more pressure on investors, tenants and developers to prioritize sustainability. Given the demand for greener buildings, we believe a program of refurbishments that are already available from brown to green is essential to reduce the operational and embodied carbon footprint of the sector. Fidelity International’s strategy aims to capitalize on this compelling opportunity by investing in the logistics sector across core Western European markets.

Since the pandemic and the domination of onshoring and reshoring trends in supply chains, the lack of available warehouse space has pushed rental returns ever higher, notwithstanding the uncertain macro backdrop. This rental growth and the yields on offer brought investors flocking to logistics in recent years, helping to make warehouses one of the asset types that has emerged as a winner in the bifurcated fortunes of the real estate market. Over the past few years, logistics vacancy levels – already close to record lows – are expected to fall further, supporting a continuation of that trend.

Climate impact of the logistics sector

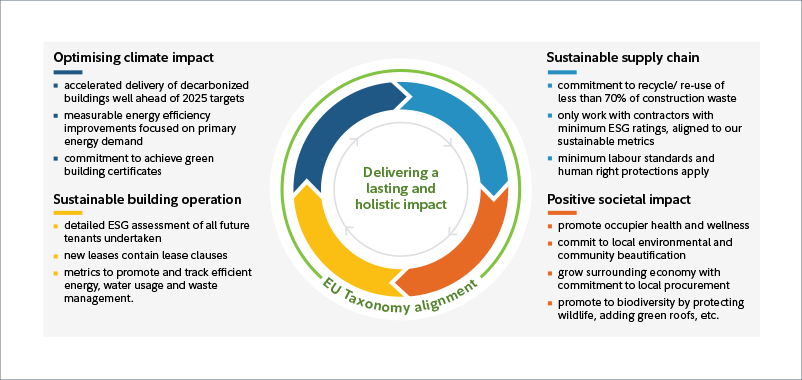

Our manage-to-green approach (see Figure 2) is focused on acquiring existing assets with the intention of retrofitting and transforming them so they can be operated with net zero emissions to meet growing occupiers’ sustainability targets. This is done by focusing on, for example, enhancing energy efficiency, optimizing the heating, cooling and lighting systems and installing photovoltaic (PV) panels.

Strategy overview

- Refurbishing existing buildings to be operated at net zero carbon (NZC), accelerating their NZC pathway.

- Delivering measurable and transparent impact: 21 metrics across the building, occupier and supplier chains.

- Aligned to SFDR Article 9 and the EU Taxonomy; seeking a reduction in primary energy demand of at least 30% for each asset.

Recent acquisitions

Late last year, we announced the purchase of three assets for the strategy. These are located in the Netherlands and Spain and are highly suitable for an “impact” type of renovation, improving the buildings’ sustainability standards and NZC capability. With the buildings being bought at an attractive discount, we believe they can deliver attractive risk-adjusted return potential over the coming years.

As demand from occupiers for prime location properties grows rapidly – while supply of quality logistics assets is constrained – we see strong rental growth potential for well-located green warehouses. Given this, we have recently moved to expand the portfolio through further acquisitions in Germany, Spain and France, with additional details outlined below.

1. Combs-la-Ville, France

Our first acquisition in France is strategically located in Combs-la-Ville at the heart of the Sénart logistics hub, a key area in the French national supply chain with only about 3% vacancy and limited future development opportunities.

One of the most well-established logistics markets in France, Sénart is located between two major production sites (Essonne and Seine-et-Marne), offering excellent transportation links, including the A5 motorway, which connects Paris to the southern cities of France, and the Francilienne, a partial ring road around the Parisian region Île-de-France. Additionally, easy access to Orly Airport further helps establish the region’s dominance as a logistics hub, offering long-term, stable income potential.

The 42,000-sqm property itself sits on a land plot of approximately 90,000 sqm and was built in 1998, before being extensively renovated in 2010. It has been vacant since July 2024, previously occupied by major logistics companies. Acquired as part of an off-market portfolio transaction, the vacant possession allows for swift execution of the business plan.

We have an ambitious capex plan to renovate the asset and significantly enhance its ESG and sustainability standards. Key renovations include the following:

- office refurbishments

- air conditioning unit replacement

- roof replacement

- PV installation on roof and/or car parking canopies

- replacement of gas-powered mechanical and electrical (M&E) systems and installation of air source heat pump

- LED installation

- facade and loading bay refurbishments

- outdoor area improvements

- tank excavation

- fire safety updates

In this context, the project perfectly aligns with our strategy, offering strong market fundamentals, excellent specifications and significant potential for sustainability improvements.

2. Nuremberg, Germany

This logistics property in Nuremberg is a high-quality asset in a strategic location with potential for energy optimization and sustainability improvements. It features market-standard, modern logistics specifications and comprises almost 19,000 sqm of rental area on a plot of nearly 33,000 sqm.

The property offers superb infrastructure connections to multiple superregional highways and benefits from being in proximity to a harbour and an airport. It was completed in 2010 and is fully let to the third-party logistics service provider Elsen Logistik GmbH.

3. Wustermark, Germany

This 25,400-sqm logistics property was built in two phases in 1997 and 2017. It is located in the Wustermark commercial area west of Berlin, providing strong transportation connections. The property combines an established location and good third-party usability with energy modernization potential.

The older part of the property is leased on a long-term basis to Schlau Großhandels GmbH & Co. KG, with the newer part set to be available for leasing from mid-2025 after the implementation of our planned manage-to-green strategy.

4. Madrid and Barcelona, Spain

The acquisition of three logistics assets in Getafe, Coslada (both around Madrid) and Polinya (Barcelona) in early 2025 brings the portfolio’s assets across the Spanish market to a total of 120,000 sqm (see Figure 3).

- Getafe. This last-mile logistics asset is strategically located in the first ring of Madrid. Integrated in the southern corridor, it offers direct access to highways and is about 20 minutes by road from the centre of Madrid and its airport. Built in 1994 and refurbished in 2014, the asset is a 44,000-sqm site, offering modern logistics specifications to meet market standards. It is currently 90% leased, and we plan to renovate the asset and to upgrade sustainability aspects.

- Coslada. This is a last-mile cross-dock logistics asset located in the first belt of Madrid in the coveted “Corredor del Henares,” which connects Madrid and Barcelona. It is only 20 minutes from the centre of Madrid and less than 10 minutes from Madrid Barajas airport, with an ideal location for regional and national distribution thanks to direct access to the highway. The 100% leased asset consists of a single building offering almost 7,000 sqm of leasable area on a 11,000-sqm site. It was completed in 1999 and offers modern, market-standard logistics specifications.

- Polinya. This is strategically located in the first ring of Barcelona. It is 30 minutes by car from the city centre and 35 minutes from the airport, with an ideal location for regional and national distribution thanks to direct access to the highway. The 100% leased asset offers approximately 14,000 sqm of gross leasable area on a land plot of approximately 22,000 sqm.

In conclusion, refurbishing existing buildings into greener facilities is not only a regulatory necessity but also a strategic imperative for real estate investors. The combination of tenant demand, stricter sustainability rules and portfolio decarbonization priorities makes green retrofits an attractive option with more immediate, higher risk-adjusted returns potential compared to new construction projects.

For investors seeking long-term income along with capital appreciation potential, an investment strategy to raise the environmental standards of existing logistics assets could provide a competitive performance edge while mitigating the effects of the climate crisis.

Important information

Marketing communication. This material is for Investment Professionals only and should not be relied upon by private investors.

Please refer to the offering documents/prospectus of the Fund before making any final investment decisions. The investment which is promoted concerns the acquisition of units or shares in a fund, and not in a given underlying asset owned by the Fund. Complete information on risks can be found in the Prospectus.

Investment objective

The Fund’s investment strategy is to renovate and reposition predominantly commercial real estate assets in Western Europe, including the U.K., to deliver sustainable workspaces.

Buildings will be selected based on their potential to deliver sustainability improvements with an expectation that the largest exposure will be to offices, followed by logistics and retail assets. The sustainable investment objective of the Fund aligns with contributing to climate change mitigation.

Risk factors

- The value of investments and the income from them can go down as well as up, and investors may not get back the amount invested, facing a risk of capital loss.

- Past performance is not a reliable indicator of future returns. The Fund’s returns may increase or decrease as a result of currency fluctuations.

- This Fund invests directly in property and land, which can be difficult to sell, and the value is generally a matter of opinion rather than fact. There may be a delay in acting on your instructions to sell your investment. The value of property is generally a matter of a valuer’s opinion rather than fact.

- Reference in this document to specific securities should not be construed as a recommendation to buy or sell these securities but is included for the purposes of illustration only.

- The Fund does not offer any guarantee or protection with respect to return, capital preservation, stable net asset value or volatility.

- There can be no assurance that a Fund’s investment objective will be achieved.

- The long-term nature of delivering returns across the economic cycle and the use of financial derivative instruments as part of an investment strategy may result in a higher level of leverage and increase the overall risk exposure of the Fund and the volatility of their Net Asset Value.

- Investments in foreign exchange transactions may also be subject to significant fluctuations, which may affect the value of an investment.

- Market risk from adverse economic impact could cause an unfavourable swift to demand and price movements.

- Liquidity risk due to assets may not be tradable quickly enough in the market we invest or traded on unfavourable prices.

- Funding risk applicable through unpredictable timing of cash flows over the life of this Fund. Additionally, if financing is structured to meet debt repayments, then this could increase the liquidity risk as well.

- Interest rate risk as it may affect the financing cost and derivation of capitalization rates which has a direct impact on demand dynamics of real estate climate impact funds.

- This document contains information about a fund currently in marketing in your country.

- Investors should note that the views expressed may no longer be current and may have already been acted upon.

- The value of investments and the income from them can go down as well as up so you may get back less than you invest.

- This Fund invests in overseas markets, so the value of investments can be affected by changes in currency exchange rates.

- This Fund invests directly in property, which can be difficult to sell, and the value is generally a matter of opinion rather than fact.

- The Fund may use third-party borrowing, and this results in leverage. Borrowing exposes the Fund to risks associated with debt financing (e.g., refinancing and interest rate risk where variable rates are applied) and creates greater potential for loss.

- Reference to specific securities should not be construed as a recommendation to buy or sell these securities and is included for the purposes of illustration only.

Fund sustainability information

- The Fund is classified as Article 9 under SFDR. For more details on our SFDR disclosures, please refer to https://www.fidelity.lu/sfdr.

- Further product-specific sustainability information can be found on the website: Sustainability-related disclosure: https://www.fidelity.lu/fidelity-real-estate-logistics-impact-climate-solutions-fund. For more information on our Fidelity Sustainable Investing Framework (FSIF) and its Real Estate Adaptations, please go to: https://fidelityinternational.com/sustainable-investing-framework/.

- The Fund integrates sustainability analysis into its investment process and has a sustainable investment objective.

- The Fund aims to achieve capital growth over the long term by investing in Sustainable Investments.

- The Fund adheres to a principle-based exclusion policy incorporating both norms-based screening and negative screening of certain sectors, companies or practices based on specific ESG criteria as determined by the investment manager from time to time. The norms-based screening includes issuers which the investment manager considers have failed to conduct their business in accordance with accepted international norms, including as set out in the United Nations Global Compact, as well as sovereign issuers on the Financial Action Task Force (FATF) blacklist and sovereign issuers identified using other internationally recognized country indicators.

- The negative screening includes issuers which have exposure to controversial weapons (biological, chemical, incendiary weapons, depleted uranium, non-detectable fragment, blinding lasers, cluster munitions, landmines and nuclear weapons); thermal coal mining and power generation (subject to transition criteria); production and/or distribution of tobacco, conventional and semi-automatic weapons; and arctic oil and gas and oil sands. The investment manager may apply revenue thresholds for more refined screens and has the discretion to implement additional sustainable requirements and exclusions.

Fidelity International Real Estate Logistics Impact Climate Solutions Fund SCA SICAV-SIF, the “Fund”, is an investment company with variable capital – specialised investment fund (société d’investissement à capital variable – fonds d’investissement spécialisé) in the form of a partnership limited by shares (société en commandite par actions) under the laws of the Grand Duchy of Luxembourg, and qualifies as a closed-ended alternative investment fund or “AIF” under the AIFM Law pursuant to the 2007 Law.

Fidelity Investments Canada ULC acts as exempt market dealer with respect to this product. In Canada, this document is for the use of Non-Individual Permitted Clients only. Investments should be made on the basis of the final approved prospectus / offering documentation, including Canadian wrapper.

FIL Investment Management (Luxembourg) S.A., a public limited company (société anonyme), incorporated under the laws of the Grand Duchy of Luxembourg, registered in Luxembourg under the company number R.C.S. Luxembourg B88635, has been appointed by the Fund, in accordance with the AIFM Agreement, to serve as the Company’s Fund’s alternative investment fund manager, the AIFM.

The registered address for both above mentioned entities is 2a, rue Albert Borschette, L-1246 Luxembourg.

FIL Investment Management (Luxembourg) S.A. reserves the right to terminate the arrangements made for the marketing of the sub-fund and/ or its shares in accordance with Article 93a of Directive 2009/65/EC and Article 32a of Directive 2011/61/EU. Prior notice of this cessation will be made in Luxembourg.

This information must not be reproduced or circulated without prior permission.

Fidelity only offers information on products and services and does not provide investment advice based on individual circumstances, other than when specifically stipulated by an appropriately authorized firm, in a formal communication with the client.

Fidelity International refers to the group of companies which form the global investment management organization that provides information on products and services in designated jurisdictions outside of North America. This communication is not directed at, and must not be acted upon by, persons inside the U.S. and is otherwise only directed at persons residing in jurisdictions where the relevant funds are authorized for distribution or where no such authorization is required.

Unless otherwise stated, all products and services are provided by Fidelity International, and all views expressed are those of Fidelity International. Fidelity, Fidelity International, the Fidelity International logo and F symbol are registered trademarks of FIL Limited.

No statements or representations made in this document are legally binding on Fidelity or the recipient. Any proposal is subject to contract terms being agreed.

We recommend that you obtain detailed information before taking any investment decision.

Investment should be made based on the latest available offering documents available in English provided via the Information Method, or available or disclosed at the registered office and Annual Reports that will be provided to Investors upon request free of charge.

Luxembourg: https://www.fidelity.lu in English. Issued by FIL (Luxembourg) S.A., authorized and supervised by the CSSF (Commission de Surveillance du Secteur Financier).

Belgium: https:www.fidelity.be in Dutch. Issued by FIL (Luxembourg) S.A., authorized and supervised by the CSSF (Commission de Surveillance du Secteur Financier).

CPA25033007

Issued by Fidelity Investments Canada ULC (“FIC”). Unless otherwise stated, all views expressed are those of Fidelity International, which acts as a subadvisor in respect of certain FIC institutional investment products or mandates.

For institutional use only.

This document is for investment professionals only and should not be relied on by private investors.

This document is provided for information purposes only and is intended only for the person or entity to which it is sent. It must not be reproduced or circulated to any other party without the prior permission of Fidelity.

This document does not constitute a distribution, an offer or solicitation to engage the investment management services of Fidelity, or an offer to buy or sell or the solicitation of any offer to buy or sell any securities in any jurisdiction or country where such distribution or offer is not authorized or would be contrary to local laws or regulations. Fidelity makes no representations that the contents are appropriate for use in all locations or that the transactions or services discussed are available or appropriate for sale or use in all jurisdictions or countries or by all investors or counterparties.

This communication is not directed at and must not be acted on by persons inside the U.S. and is otherwise only directed at persons residing in jurisdictions where the relevant funds are authorized for distribution or where no such authorization is required. Fidelity is not authorized to manage or distribute investment funds or products in, or to provide investment management or advisory services to persons resident in, mainland China. All persons and entities accessing the information do so on their own initiative and are responsible for compliance with applicable local laws and regulations and should consult their professional advisors.

Reference in this document to specific securities should not be interpreted as a recommendation to buy or sell these securities but is included for the purposes of illustration only. Investors should also note that the views expressed may no longer be current and may have already been acted upon by Fidelity. The research and analysis used in this documentation is gathered by Fidelity for its use as an investment manager and may have already been acted upon for its own purposes. This material was created by Fidelity International.

This article has been provided by Fidelity Investments Canada ULC (Fidelity) and is for informational purposes only. It comprises, among other things, examples of sustainable investing activities across Fidelity and FIL Limited (Fidelity International) only, current as of December 9, 2024. The article may refer to ESG considerations that Fidelity and Fidelity International may take into account as part of their research or investment process, and is not necessarily reflective of the approach of any other Fidelity Investments company or subadvisor, such as Fidelity Management & Research Company LLC, FIAM LLC, Geode Capital Management LLC and State Street Global Advisors Ltd., to ESG research, stewardship and sustainable investing, either specifically or generally.

Past performance is not a reliable indicator of future results.

This document may contain materials from third parties which are supplied by companies that are not affiliated with any Fidelity entity (third-party content). Fidelity has not been involved in the preparation, adoption or editing of such third-party materials and does not explicitly or implicitly endorse or approve such content.

Fidelity International refers to the group of companies which form the global investment management organization that provides products and services in designated jurisdictions outside of North America. Fidelity, Fidelity International, the Fidelity International logo and F symbol are trademarks of FIL Limited. Fidelity only offers information on products and services and does not provide investment advice based on individual circumstances.

©2025 Fidelity Investments Canada ULC. All rights reserved.