The rise of the stay-in-plan model

As older participants opt to stay in retirement plans, plan sponsors have options to support their diverse needs.

A feature article from our U.S. partners.

Originally published in April 2024.

Highlights

- A growing number of pre-retirees and retirees are opting to stay in plan, and a majority of plan sponsors prefer allowing older participants to stay in their plans beyond separation from service.

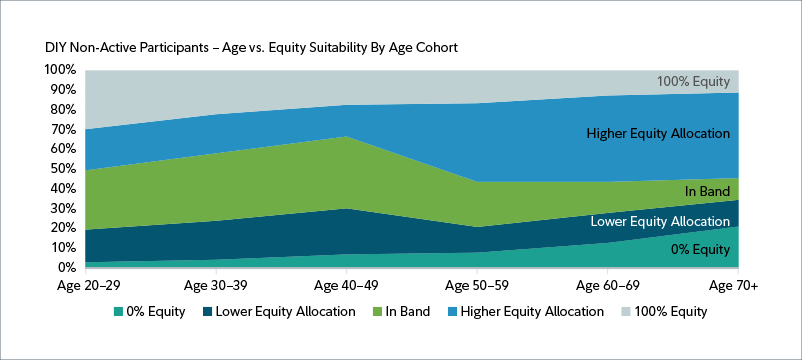

- When evaluating which plan options may appeal to retired participants who choose to stay in plan, plan sponsors may want to consider the diversity of their employees’ needs.

- Offering diverse options for retirees who choose to stay in plan can help address five interrelated categories of risk: longevity risk, investment risk, utilization risk, complexity risk, and liquidity risk. Every participant—and every stay-in-plan option—will weigh these risks differently.

- For retirees who choose to stay in plan, plan sponsors may want to consider a suite of options—including education, tools, and investment and income offerings—that can serve the varied needs of participants as they enter retirement and begin to spend down their assets

Source: Fidelity Investments; investment allocations as of December 31, 2022.