Direct lending: Does borrower size matter?

A closer look at risk and returns. The rest of the story...

Originally published in January 2025 by Fidelity Investments.

Written by David Gaito, Head of Direct Lending, and Audie Apple, Direct Lending Institutional Portfolio Manager.

Highlights

- Defaults are generally viewed as a sign of an imminent loss, but not all defaults are the same.

- Financial covenant defaults protect capital by forcing the borrower back to the negotiating table before a payment is missed.

- Leverage matters. Larger borrowers generally use more debt in their capital structure, increasing the risk profile of the loan.

- Financial covenants, combined with lower capital structure leverage, have produced slightly higher returns and narrower dispersion for direct loans in the lower middle market versus the upper middle market.

Some investors may assume that “bigger is better” when it comes to direct lending: the larger the borrower, the safer the credit. Higher covenant default rates by smaller borrowers are of ten used to support this argument. However, financial covenant defaults are very dif ferent from payment defaults, which occur when a borrower misses a payment on a loan. Financial covenants are an important feature of private loans that protect the lender by forcing the borrower back to the negotiating table when violated, before the enterprise value collateralizing the loan is materially impaired.

Understanding how financial covenants play a key role in protecting capital for lenders before a payment default, Exhibit 1 suggests that loans to smaller companies generally have stronger covenants. These structures meaningfully mitigate the risk profile of the loan. The early intervention and closer oversight facilitated by financial covenants can serve as an effective defense against a payment default, which could result in realized losses for the lender.

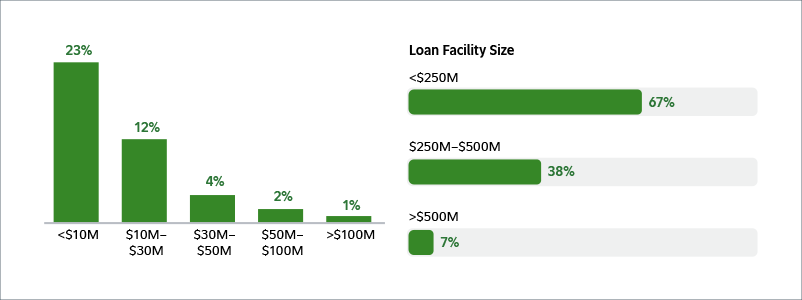

Meaningful financial covenants are quite common in the lower middle market but are relatively rare when lending to larger borrowers. The data depicted in Exhibit 2 illustrates the prevalence of financial covenants by the size of the total senior loan facility, which is closely associated with the size of the borrower. Loans for smaller borrowers are ~9-10X more likely to have a financial covenant than loans for larger borrowers.

EXHIBIT 1: Direct lending financial covenants are generally stronger for lower middle market borrowers. Financial covenant defaults by borrower size

EXHIBIT 2: Financial covenants are more prevalent in lower middle market loans. Percentage of loans with financial covenants1

Exhibit 1: Source: Lincoln International Valuation & Opinions Group. Data represents average for each borrower cohort over the trailing four quarters ending June 30, 2024.

Exhibit 2: Source: 1. Moody’s Investor Services - Report on Private Credit, October 2023.