Dedicated specialists with expertise in pension plan risk management across assets and liabilities.

We have been providing fixed-income solutions for more than 50 years and manage more than $3.3 trillion globally.1

The Fidelity fixed income advantage

Extensive, independent and proprietary research spanning the capital structure

Proprietary, integrated and rigorous risk management platform

Our fixed-income specialist teams work in collaboration with our equity analysts to form a 360° view on issuers, providing information and screening advantage.

Our integrated approach enables us to increase the number and diversity of strategies employed in a portfolio.

We have strong expertise designing bespoke solutions for clients, including a dedicated team specializing in Liability-Driven Investing.

Portfolios employ proprietary risk measurement systems and are supported by strong compliance and oversight functions.

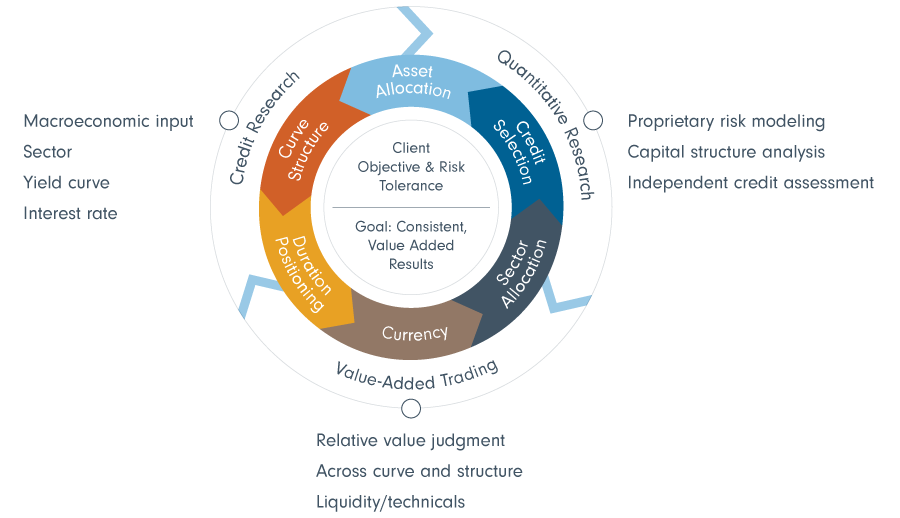

A custom approach to balancing risk and return

A well-defined investment philosophy based on in-house credit, quantitative and macro research, along with specialist teams across the globe, ensures we deliver portfolios aligned with our clients’ investment goals.

Liability Driven Investing (LDI)

Fidelity’s LDI solutions platform is based on four key principles:

LDI Philosophy and Approach

Meet the LDI team

Before assuming his current role, Mr. Tremblay held a number of senior positions at Fidelity, including institutional portfolio manager, senior vice-president and fixed-income investment director. He has been in the industry since 1995.

Fixed income solutions

For full details of the applicable mandates, including the investment objectives, please contact Fidelity Canada Institutional.

Meet the fixed income leadership team

Prior to assuming her current responsibilities, Ms. Martin was a portfolio manager responsible for managing several institutional portfolios, mutual funds and also co-managed various investment-grade bond subportfolios, available exclusively to Canadian investors. Previously, Ms. Martin managed short-term and stable value portfolios for Fidelity’s insurance company and institutional clients. She was also a trader for Fidelity’s Taxable Bond group. She has been in the financial industry since 1995.

Prior to assuming his current responsibilities, Dr. Gupta served as head of fixed income quantitative research in the Quantitative Research and Investments division (QRI) at Fidelity Investments. Previously he worked with Liability Driven Investing (LDI) and long Duration Bond Investment teams and before that he helped build and manage the fixed income quantitative development and associate groups for Fidelity India.

Before joining Fidelity in 2005, Dr. Gupta was a professor of information systems and telecommunications at the University of Texas at Dallas and at Oklahoma State University. He has been in the financial industry since joining Fidelity in 2005.

Prior to her current position, Ms. Le Morhedec served as Global Head of Fixed Income at AXA IM and sat on the firm’s management board. In that role, Marion led a team of 110 professionals across eight locations, overseeing €428 billion in assets under management across a wide range of fixed income strategies and client segments.

Ms. Le Morhedec joined Fidelity in 2025 and has been in the financial industry since 1998.

1 Fixed income assets under management as at December 31, 2024, in Canadian dollars.