We focus on identifying opportunities that offer stable earnings growth through an investment cycle.

The Fidelity equity advantage

Our goal is to deliver strong and consistent investment performance to help clients achieve their investment objectives.

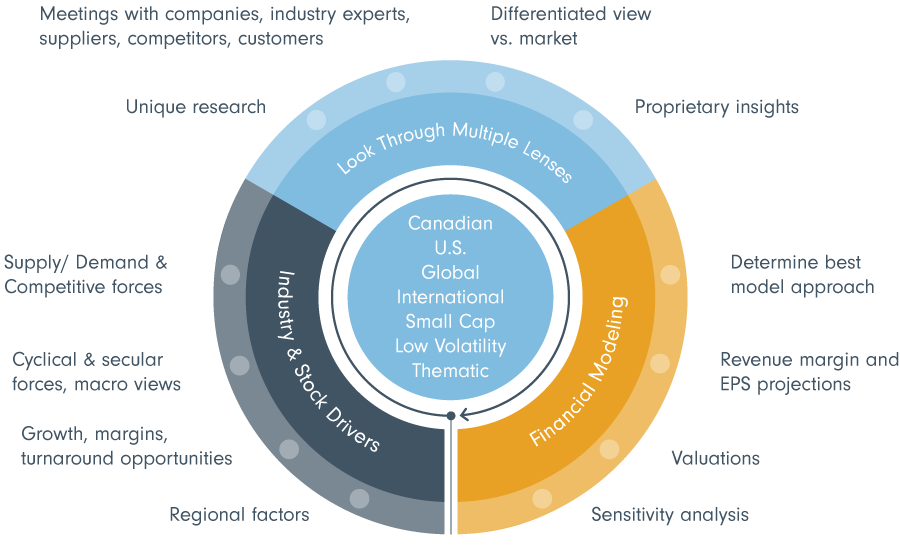

Our fundamental-focused 360° research approach allows us to develop a unique understanding of the businesses in which we invest.

We meet with thousands of companies face to face and leverage our global research network to understand their competitors, customers and suppliers.

Core and opportunistic research provides entrepreneurial and established investment ideas.

Our investment offices span the globe to deliver expertise in local markets.

Proprietary technology integrates research with portfolio construction tools. Risk evaluation informs balance and composition.

Our experienced team of risk management professionals uses proprietary risk management technology and quantitative risk modelling to assess real-time portfolio risks.

A flexible and thorough research process provides a differentiated view

Idea generation is combined with active management and risk controls to construct portfolios that focus on delivering risk adjusted results.

Equity Investment Solutions

For full details of the applicable mandates, including the investment objectives, please contact Fidelity Canada Institutional.

Meet the equity leadership team

Prior to her current position, Ms. Reilly has held several management roles. These include global head of equity research, and chief investment officer for several teams including Large Cap Core, Growth, Mid Cap, and Capital Appreciation teams.

Ms. Reilly joined Fidelity in 2004 and has been in the financial industry since 1993.

Prior to his current role, Mr. Enyeart has held several management positions. Among others, he served as President of Strategic Advisers LLC and was Chief Investment Officer and Managing Director for Research for Fidelity’s Asset Management Equity division.

Mr. Enyeart joined Fidelity in 2006 and has been in the financial industry since 1994.

Mr. Marchese joined Fidelity in 1998 and has played a pivotal role in leading and building out Fidelity’s dedicated Canadian investment team. He has been in the investments industry since 1998.