Defining and Selecting Strategic Asset Exposures for Target Date Investors

An effective target date strategy provides diversification, reflect members’ long-term investment horizons, and employs a disciplined process to establish the strategic asset allocation.

Highlights

- Strategic asset allocation is the primary driver of a target date fund’s performance over time, and diversification is one of the most powerful tools for helping retirement investors navigate the uncertainty of capital markets.

- The Fidelity Target Date team’s strategic allocation process for target date funds emphasizes assets that earn a long-term return, display independent attributes in different investment environments, and offer durable implementation characteristics.

- Our proprietary research provides insight into how asset classes behave during each of five distinct market regimes and in response to a common set of risk factors, highlighting those assets that offer unique sources of diversification.

- Rising concerns over higher global debt and lower GDP growth reinforce the need for a strategic asset allocation diversified across market regimes rather than concentrated in a limited set of risk factors.

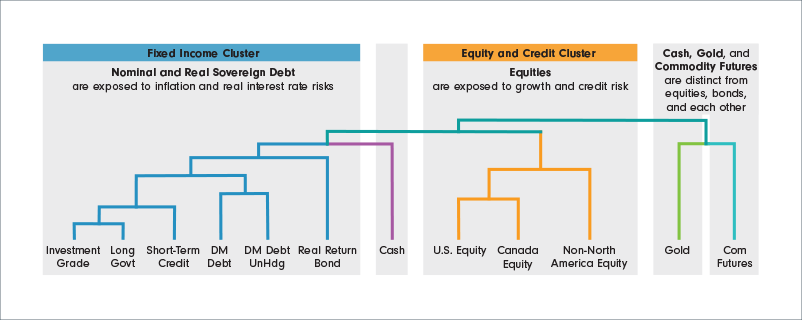

Clustering analysis reveals historical relationships among asset classes

CDN: Canadian. DM: developed markets. Hgd: hedged. Sov: Sovereign. Commod: commodity. Hierarchical clustering of asset classes based on historical average correlation (1950–2019). The height of each vertical line indicates the strength of the relationship between asset groups. Source: Fidelity Investments, as of 12/31/20