Capital market assumptions: A comprehensive global approach for the next 20 years

We believe that asset returns over the next 20 years will be lower than their long-term averages, with stocks outperforming bonds and emerging markets generating the highest returns.

Originally published by our U.S. partners and updated in August 2025.

Written by Irina Tytell, Head of Secular Asset Allocation Research, Minfeng Zhu, Senior Research Analyst, Dirk Hofschire, Director of Asset Allocation Research, and Anna Srapionyan, Quantitative Analyst.

Highlights

- Our secular return expectation for U.S. equities is below the long-term average due to lower growth potential and higher starting valuations.

- Our fixed income return expectations are near the long-term average, reflecting the broad alignment of starting bond yields with our secular views.

- As a result, we continue to expect U.S. stocks to outperform bonds, but by a smaller margin relative to history.

- We expect non-U.S. equity returns, especially in emerging markets, to exceed those of the U.S. while remaining lower than their respective long-term averages.

- Our capital market assumptions can help inform strategic asset allocation decisions by focusing on how economic and financial market inputs influence asset returns over long periods of time.

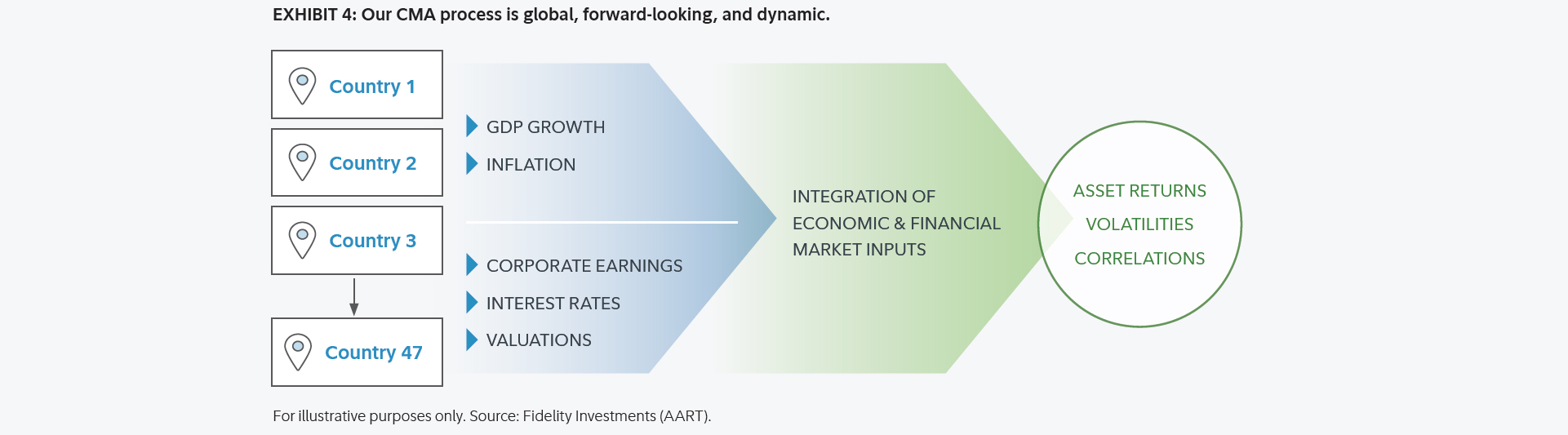

Our capital market assumptions framework focuses on the specifics of how economic and financial market inputs influence asset returns over long periods of time. While other approaches assume the connection between GDP growth and asset returns is either perfect or non-existent, our framework is built on two beliefs:

- There is a principal relationship between economic trends and asset-class performance.

- By deriving country-specific assumptions, we generate estimates that are global and adaptive across diverse economies and asset categories.