Our fixed-income solutions leverage the expertise of experienced portfolio managers who are backed by teams that specialize in a wide range of Canadian and global fixed-income asset classes.

We have been providing fixed-income solutions for more than 50 years and manage more than $3.3 trillion globally.1

The Fidelity fixed income advantage

Disciplined and collaborative team approach

Portfolio design and a culture of prudent risk management

A custom approach to balancing risk and return

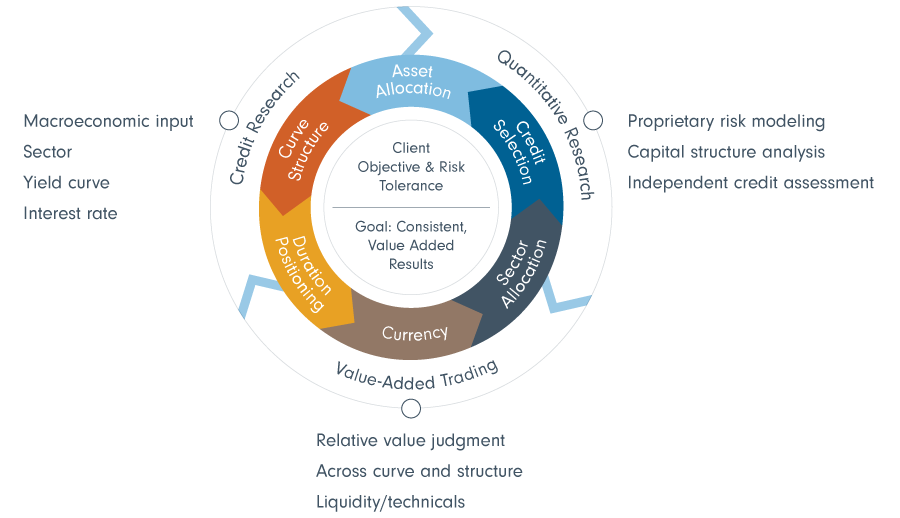

A well-defined investment philosophy based on in-house credit, quantitative and macro research, along with specialist teams across the globe, ensures we deliver portfolios aligned with our clients’ investment goals.

Liability Driven Investing (LDI)

Fidelity’s LDI solutions platform is based on four key principles:

Dedicated

Resources

Dedicated specialists with expertise in pension plan risk management across assets and liabilities.

Custom Portfolio Solutions

Real-world implementations that take into consideration current capital market dynamics and implementation challenges.

Strong Fixed Income Management

Seeks to consistently deliver alpha in a pension risk management framework.

Development of Customized Solutions

De-risking solutions that seek to meet the evolving needs of pension clients.

Investment process

Meet the LDI team

Fixed income solutions

This information is designed to provide an indication of certain attributes of these strategies and is subject to change. For full details of the applicable mandates, including the investment objectives, please contact Fidelity Canada Institutional.

We offer a comprehensive lineup of institutional investment strategies and mutual funds available on all major recordkeeping platforms.

Meet the fixed income leadership team

1 Fixed income assets under management as at December 31, 2024, in Canadian dollars.